Will the Global South break free from dollarized debt?

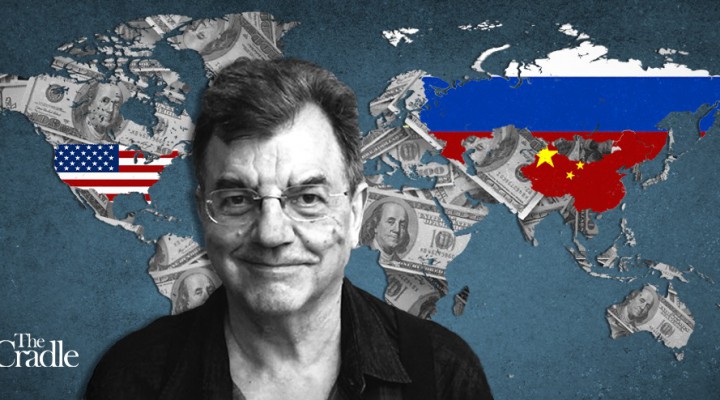

In his latest book, economist Michael Hudson pits socialism against finance capitalism and tears apart the ‘dream civilization’ imposed by the 1 percent.

With The Destiny of Civilization: Finance Capitalism, Industrial Capitalism or Socialism, Michael Hudson, one of the world’s leading independent economists, has given us arguably the ultimate handbook on where we’re at, who’s in charge, and whether we can bypass them.

Let’s jump straight into the fray. Hudson begins with an analysis of the “take the money and run” ethos, complete with de-industrialization, as 90 percent of US corporate revenue is “used to share buybacks and dividend payouts to support company stock prices.”

That represents the apex of “Finance Capitalism’s” political strategy: to “capture the public sector and shift monetary and banking power” to Wall Street, the City of London and other western financial centers.

The whole Global South will easily recognize the imperial modus operandi: “The strategy of US military and financial imperialism is to install client oligarchies and dictatorships, and arm-twist allies to join the fight against designated adversaries by subsidizing not only the empire’s costs of war-making (“defense”) but even the imperial nation’s domestic spending programs.” This is the antithesis of the multipolar world advocated by Russia and China.

In short, our current Cold War 2.0 “is basically being waged by US-centered finance capitalism backing rentier oligarchies against nations seeking to build up more widespread self-reliance and domestic prosperity.”

Hudson presciently reminds us of Aristotle, who would say that it is in the interest of financiers to wield their power against society at large: “The financial class historically has been the major beneficiary of empires by acting as collection agents.”

So inevitably the major imperial leverage over the world, a true “strategy of underdevelopment,” had to be financial: instrumentalizing IMF pressure to “turn public infrastructure into privatized monopolies, and reversing 20th century pro-labor reforms” via those notorious ‘conditionalities’ for loans.

No wonder the Non-Aligned Movement (NAM), established in Belgrade in 1961 with 120 nations and 27 observers, became such a threat to US global strategy. The latter predictably fought back with a slew of ethnic wars and the earliest incarnations of color revolution – fabricating dictatorships on an industrial scale, from Suharto to Pinochet.

The culmination was a cataclysmic Houston get-together in December 19, 1990 “celebrating” the dissolution of the USSR, as Hudson reminds us how the IMF and the World Bank “laid out a blueprint for Russia’s leaders to impose austerity and give away its assets – it didn’t matter to whom – in a wave of ‘shock therapy’ to let the alleged magic of free enterprise create a neoliberal free-for-all.”

Lost in a Roman wilderness of debt

To a large extent, nostalgia for the rape-and-pillaging of 1990s-era Russia fuels what Hudson defines as the New Cold War, where Dollar Diplomacy must assert its control over every foreign economy. The New Cold War is not waged only against Russia and China, “but against any countries resisting privatization and financialization under US sponsorship.”

Hudson reminds us how China’s policy “followed almost the same path that American protectionism did from 1865 though 1914 – state subsidy for industry, heavy public-sector capital investment…and social spending on education and health care to upgrade the quality and productivity of labor. This was not called Marxism in the United States; it was simply the logical way to look at industrialization, as part of a broad economic and social system.”

But then, finance – or casino – capitalism gained steam, and left the US economy mainly with “agribusiness farm surpluses, and monopolies in information technology (largely developed as a by-product of military research), military hardware, and pharmaceutical patents (based on public seed-money to fund research) able to extract monopoly rent while making themselves largely tax-exempt by using offshore banking centers.”

That’s the current State of Empire: relying only “on its rentier class and Dollar Diplomacy,” with prosperity concentrated in the top one percent of establishment elites. The inevitable corollary is US diplomacy imposing illegal, unilateral sanctions on Russia, China and anyone else who defies its diktats.

The US economy is indeed a lame post-modern remake of the late Roman empire: “dependent on foreign tribute for its survival in today’s global rentier economy.” Enter the correlation between a dwindling free lunch and utter fear: “That is why the United States has surrounded Eurasia with 750 military bases.”

Delightfully, Hudson goes back to Lactantius, in the late 3rd century, describing the Roman empire on Divine Institutes, to stress the parallels with the American version:

“In order to enslave the many, the greedy began to appropriate and accumulate the necessities of life and keep them tightly closed up, so that they might keep these bounties for themselves. They did this not for humanity’s sake (which was not in them at all), but to rake up all things as products of their greed and avarice. In the name of justice they made unfair and unjust laws to sanction their thefts and avarice against the power of the multitude. In this way they availed as much by authority as by strength of arms or overt evil.”

Socialism or barbarism

Hudson succinctly frames the central issue facing the world today: whether “money and credit, land, natural resources and monopolies will be privatized and concentrated in the hands of a rentier oligarchy or used to promote general prosperity and growth. This is basically a conflict between finance capitalism vs. socialism as economic systems.”

To advance the struggle, Hudson proposes a counter-rentier program which should be the Global South’s ultimate Blueprint for responsible development: public ownership of natural monopolies; key basic infrastructure in public hands; national self-sufficiency – crucially, in money and credit creation; consumer and labor protection; capital controls – to prevent borrowing or denominating debts in foreign currency; taxes on unearned income such as economic rent; progressive taxation; a land tax (“will prevent land’s rising rental value from being pledged to banks for credit to bid up real estate prices”); use of the economic surplus for tangible capital investment; and national self-sufficiency in food.

As Hudson seems to have covered all the bases, at the end of the book I was left with only one overarching question. I asked him how he analyzed the current discussions between the Eurasia Economic Union (EAEU) and the Chinese – and between Russia and China, further on down the road – as being able to deliver an alternative financial/monetary system. Can they sell the alternative system to most of the planet, all while dodging imperial financial harassment?

Hudson was gracious enough to reply with what could be regarded as the summary of a whole book chapter: “To be successful, any reform has to be system-wide, not merely a single part. Today’s western economies have become financialized, leaving credit creation in private hands – to be used to make financial gains at the expense of the industrial economy… This aim has spread like leprosy throughout entire economies – their trade patterns (dependency on US agricultural and oil exports, and IT technology), labor relations (anti-unionism and austerity), land tenure (foreign-owned plantation agriculture instead of domestic self-reliance and self-sufficiency in food grains), and economic theory itself (treating finance as part of GDP, not as an overhead siphoning off income from labor and industry alike).”

Hudson cautions that “in order to break free of the dynamic of predatory finance-capitalism sponsored by the United States and its satellites, foreign countries need to be self-sufficient in food production, energy, technology and other basic needs. This requires an alternative to US ‘free trade’ and its even more nationalistic ‘fair trade’ (deeming any foreign competition to US-owned industry ‘unfair’). That requires an alternative to the IMF, World Bank and ITO (from which Russia has just withdrawn). And alas, an alternative also requires military coordination such as the SCO [the Shanghai Cooperation Organization] to defend against the militarization of US-centered finance capitalism.”

Hudson does see some sunlight ahead: “As to your question of whether Russia and China can ‘sell’ this vision of the future to the Global South and Eurasian countries, that should become much easier by the end of this summer. A major byproduct (not unintended) of the NATO war in Ukraine is to sharply raise energy and food prices (and shipping prices). This will throw the balance of payments of many Global South and other countries into sharp deficit, creating a crisis as their dollar-denominated debt to bondholders and banks falls due.”

The key challenge for most of the Global South is to avoid default:

“The US raise in interest rates has increased the dollar’s exchange rate not only against the euro and Japanese yen, but against the Global South and other countries. This means that much more of their income and export revenue must be paid to service their foreign debt – and they can avoid default only by going without food and oil. So what will they choose? The IMF may offer to create SDRs to enable them to pay – by running even further into dollarized debt, subject to IMF austerity plans and demands that they sell off even more of their natural resources, forests and water.”

So how to break free from dollarized debt? “They need a critical mass. That was not available in the 1970s when a New International Economic Order was first discussed. But today it is becoming a viable alternative, thanks to the power of China, the resources of Russia and those of allied countries such as Iran, India and other East Asian and Central Asian countries. So I suspect that a new world economic system is emerging. If it succeeds, the last century – since the end of World War I and the mess it left – will seem like a long detour of history, now returning to what seemed to be the basic social ideals of classical economics – a market free from rent-seeking landlords, monopolies and predatory finance.”

Hudson concludes by reiterating what the New Cold War is really all about:

“In short, it is a conflict between two different social systems, each with their own philosophy of how societies work. Will they be planned by neoliberal financial centers centered in New York, supported by Washington’s neo-cons, or will they be the kind of socialism that the late 19th century and early 20th century envisioned – a ‘market’ and, indeed, society free from rentiers? Will natural monopolies such as land and natural resources be socialized and used to finance domestic growth and housing, or left to financial interests to turn rent into interest payments eating into consumer and business income? And most of all, will governments create their own money and steer banking to promote domestic prosperity, or will they let private banks (whose financial interests are represented by central banks) take control away from national treasuries?”

TheAltWorld

TheAltWorld

0 thoughts on “Will the Global South break free from dollarized debt?”