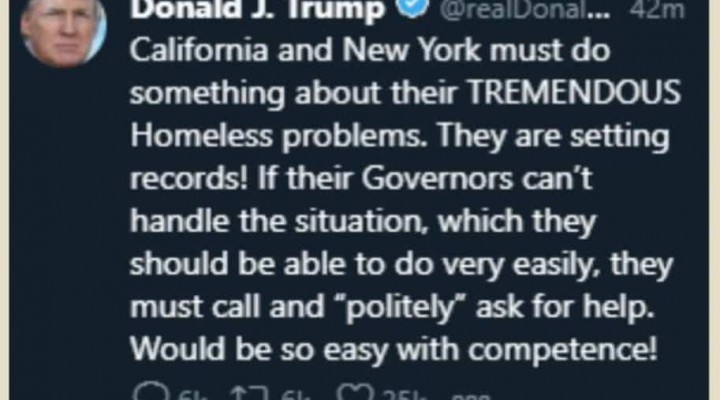

Trump’s Policies: How America is Being Engineered into Mass Homelessness

Introduction:

This was sitting in my email, one piece of the 500 a day I actually read, as many can attests, although too often my answers are truncated. Now you know why.

This we are publishing, a comment by someone, from somewhere which makes glorious reading. It helps explain why someone with 7 digits of investments in a bull market still works into their 70s. 2k per month in property taxes alone.

It would have been smarter to buy a trailer, generator and live in the woods. Which reminds me…

During the Reagan/GHWB years, homelessness and flooded not just cities. I took two of my kids winter camping in the Manistee National Forest, driving my very offroad 4runner miles on oddly well traveled logging trails. I found a “town” of sorts, families living in small trailers and ad hoc insulated tents, dozens of them, miles from any road.

Kids were being driven to school, parents held jobs…families were living “off the grid” because there was no housing, no adequate employment for what had been union industrial workers, even skilled trades, who now had nothing.

In town, Grand Rapids, a town of cardboard boxes and small sheds existed under the “S Curve” under US 131 as it passed through town, maybe 2000 people.

Every city had that, now its worse and spreading across the country. These are addicts or mental patients and their are children there. Very good read below:

This sort of thing pisses me off.

Just NY and California eh?

Uh, no. Been to Chicago lately? The last time I drove through there, which wasn’t all that long ago, there were tent cities visible from the Dan Ryan right near the Loop.

Now when I lived there, which I did for 13 years in the metro area (including several in the city proper) there were always a few homeless bums living on Lower Wacker. Why? Because in the winter you had a shot at survival with the warm(er) air exhaust from the buildings down there, and you were at least somewhat sheltered from the often-nasty North winter winds coming off the lake.

But not like this.

This isn’t just Trump’s problem, but he’s not only done nothing to resolve it he’s made it worse. All the “stock market” rah-rah has continued to drive up the cost of living, especially housing, in places like NY, Chicago, Washington State and California. It’s not just the cost of housing per-se, it’s also property taxes, which have in many of those areas doubled or more.

The last two homes I had in the Chicago area — one a townhouse, and a single family home — have both doubled their tax load. This is not uncommon — in fact, I dare you to find large metro areas where similar things have not occurred.

If you rent that doubling goes directly into your rent, so there is no escape from it.

The property tax on the townhouse today is nearly $700/month! That’s about double the rent I paid on an apartment when I first moved to Chicago, just for property taxes!

If I have a $10/hour job and work 40 hours a week I have $20,000 a year in gross income. I can’t even pay the property taxes on that townhouse with a reasonable 30% of my gross allocated to capital housing expenses — say much less the amortization note. Oh, and I haven’t paid the water, sewer, power and garbage bill yet either.

Zillow “estimates” the rent on that townhouse is almost $3,000/month. It is not an ostentatious place; 2 bedrooms, 2 baths, 1,700 square feet. I bought it newly constructed, so I know exactly what it looks like both inside and out. It’s nice, but nothing special.

You need roughly $90,000 of income to be able to reasonably afford to rent that place. If you decided to buy it, and could qualify for a 4% 30 year mortgage and financed the whole thing your P&I would be $2,566.11 + $684.17 in property tax escrow, or $3,250.27 per month. There’s also a monthly HOA maintenance fee; I have no idea what that runs nowdays but I bet it’s not cheap — but being a townhouse it’ll be better than a condo, in that the common area maintenance is limited to the driveways and such. Note that the current rental estimate is below the capital cost of acquisition, which means it will never cap out for the owner if you rent it; all they are doing is speculating on further (very significant) price increases, which are rather unlikely with the ratcheting taxes! Further, you’d also need roughly $90,000 worth of income to buy the house, assuming you can evade PMI which means you need 20% (or a bit over $100,000 in cash as a down payment) — and that gives you near-zero margin. Better hope your income rises faster than the taxes do or you’ll be homeless inside of five years.

The median household income in Chicago is $55,000 by the way.

And again, this isn’t an ostentatious place and it has no dirt that you personally own. It’s just a rowhouse — a decent place to live with off-street parking as most of the bottom floor.

It’s worse in NYC, any of the cities in California on the coast, and the entire Washington state Sea-Tac area.

Much worse.

What led to this?

Deficit spending and interest-rate suppression led to this, caused it, and continues to cause it through the following mechanisms:

1. Below GDP rates anywhere in the interest curve destroy capital for any bondholder who actually buys said bonds for the coupon or protection of principal. On a purely monetary basis all such bonds lose money; the only remaining purpose in buying such a bond is to speculate that rates will fall further and thus you can obtain a capital gain.

2. Below GDP rates anywhere in the interest curve result in people being paid to borrow in that the rate of interest is below the rate of monetary inflation and thus they “expand” in ways that are uneconomic. This in turn results in executives and majority shareholders, who comprise fewer than 1% of all employees for any reasonably-large firm and fewer than 5% even for smaller ones (e.g. under 1,000 employees), becoming extremely rich. Among the ways they do that is with stock buybacks funded with debt issuance at, of course, below-GDP expansion rates. Over time this literally steals the company’s equity from the shareholders and transfers it to the executives — it used to be illegal to buy back stock in most instances for this very reason. You could, of course, direct the SEC to reverse their ruling and return to the previous set of regulations — ending that screwjob permanently.

3. This handful of extremely rich people bid up the capital assets (land and houses) in said given area. They can afford it because they’re being paid to take on new debt obligations which they are not personally responsible for since a corporation is doing the borrowing. Nobody else can do that, including the dude driving the Uber, the chick pulling the Starbucks coffee, the small business owner who the bank insists personally guarantee his loans (nor can he get the below-GDP rate) and the guy driving the city bus or subway train that transports all of the “ordinary people” to and from work. Since said people have no personal guarantee on said borrowing when it blows up, as it mathematically must, they keep the money.

4. Nobody else — including the common person with a 401k — gets enough of that diluted money to matter. If you have a $100,000 gain in your 401k you feel great right up until you realize after you retire that in five years that “gain” has been entirely consumed by your property taxes that have more than doubled and you have to pay income tax on the distributions from the 401k too! But since said people “feel” rich, not realizing that their entire gain plus some is obligated on a forward basis many of said common people will be stupid enough to blow up their credit card with it’s 20+% interest rate! Oh look, consumer spending is up — isn’t that fantastic!

5. Pension funds cannot earn a safe, positive return in the bond market due to #1. They are therefore forced into other investments such as stocks, which further stokes the bubble. That would be bad enough but the malinvestment in #2 makes the costs those funds have to cover, such as health care and health insurance, rise at rates much faster than GDP, which means there’s no possible way for said pension funds to remain solvent. This in turn drives property taxes even higher because the operating expenses for the city, county and state must be met.

6. The below-GDP rate borrowing also funds so-called “gig economy” businesses that are non-viable without said theft; they in turn entice people to take so-called “jobs” that make utterly zero sense. Uber is a prime example of this but hardly the only one; if you take the gross cost of a ride, subtract the commission including the “ticket fees”, then deduct from that the end-to-end mileage at the IRS deduction rate (which is a decent estimate of actual cost, including depreciation of the vehicle, professional maintenance and similar), then subtract a further 7.65% for the “employer” half of FICA and Medicare that an employer would pay but a contract must on his own, then divide by the hours in the vehicle you’ll find that most of said persons make less than minimum wage. But even if they made $10/hour — which on a percentage basis effectively none do — that is, well over the federal minimum wage they cannot afford to live anywhere in those areas on $20,000 of income a year. These alleged “jobs” are all non-viable; every one of these firms is an extraction racket, ought to be felonious, and literally screws every single person “working for” said firm other than the top executives to within an inch of their lives.

7. State and local governments who try to pass “raise the wage” laws (e.g. $15/minimum hourly wage) are counter-productive in that the gig economy “workers” are exempt since they’re contractors, and the places (e.g. coffee shops, fast food joints, etc) that aren’t are non-viable as businesses with that cost structure because the costs embedded into their facility rent and mandated benefit costs make such an increase impossible to absorb or pass through. Some will try but nearly all will fail and go out of business. Those firms that remain cut hours by 30% or more which leads the employees to not gain a penny in terms of actual take-home pay, automating what they can to fill the gap. If that’s not possible the company disappears and now nobody who used to work there has any income. The problem isn’t the minimum wage — it’s the ratcheting costs that come from intentional destruction of the purchasing power of funds imposed by deficit spending and suppressed interest rates. Attempting to mandate higher wages simply adds more of those ratcheting costs and compounds the destruction rather than being helpful.

8. The smaller business owner, who cannot access borrowed funds he is not personally responsible for nor can he get the below-GDP rate, gets it in both holes. 95%+ of those firms lease their office, warehouse or manufacturing space. Virtually all commercial leases are triple net, so as the property taxes and operating expense (e.g. the building management, security, etc) rise so does their monthly nut. Since these costs rise much faster than GDP does and his large-firm competitors are being paid to borrow and thus can spend those funds on money losing acts to steal customers eventually said small businessperson is forced out of business entirely. The firm I ran in Chicago in the 1990s would be non-viable today due to these expenses; its entire pre-tax operating margin would be consumed by both them and the higher employment costs, specifically health insurance.

9. In short deficit spending always and everywhere causes purchasing power destruction in the exact amount of the deficit as a percentage of the economy. However, the spread of that destruction is uneven; specifically, it falls directly on those things that cannot be offshored to slave labor in China which means the common person, who has to buy services produced here, such as education (e.g. college), medical care and of course pay taxes see their cost of living skyrocket far beyond their meager increase in income. It also directly destroys small firms that cannot access non-recourse funding at rates below that of GDP expansion.

The end result is that those who are not the executives and in that top 5% or so of the earners cannot afford a place to live. As they fall off the tax rolls in that they contribute less in taxes than they cost the city, county, state and federal governments the problem becomes exponentially worse in that it further drives up deficits if the government employee screaming is met with more unfunded spending — and both you and Obama have done exactly that. For every 1 dude that finds “success” in that so-called “economy 99 more drop down a peg on the ladder in terms of paying more in taxes than they consume and a significant number of them fall off the bottom, lose their jobs and then wind up evicted.

I remind you that the previous time you signed such a budget bill containing said huge deficits you said you’d never do it again. I wish political promises that were immediately broken the next time the issue arose were met with God striking you with a bolt from the blue because you just did do it again you lying sack of ****. I suppose you expect the American people to be too ****ing stupid to remember what you said last time. Unfortunately for you I do remember.

Or, perhaps, for the ordinary person who isn’t inclined to commit homicide when you intentionally screw him or her and thus when faced with despair and no realistic way out of it where they live today other than armed revolt will exercise a bit of wisdom, get in their vehicle and tell the city to stuff it, moving somewhere else. That may ultimately be a rubes game in that the problem will follow them, but they may outrun the plague until their natural life expectancy has been exceeded. But a significant percentage, especially young people who expect to live a long time and those who have been screwed repeatedly, seeing that they’ve been raped up the ass out of the American Dream by ****faces like you Donald Trump, along with Obama before you and ALL of the legislators in both parties, realize that they have no refuge in either political persuasion and no reasonable prospect of a civil, peaceful resolution to the problem either. Neither your bull**** or Obama’s brought solace and improvement; both instead brought ruin.

Some percentage of those people will quite-logically deduce that they may as well self-medicate and simply tell the world — and you — to go **** a goat. So they do — they grab a bottle, a pill or a syringe. Oh, and your cronies in the medical monopolist system help them with that too, in many cases feeding them SSRIs which turn them into a ****ing zombie, destroying their ambition. Drugs and alcohol abuse come next.

Now, having done that, they’re unemployable. Not that it really matters much — why would you work your ass off at a menial job when doing so doesn’t even provide you with a place to live and food to eat?

All of this comes back to deficits and interest-rate suppression — which you, Donald Trump, are stupid enough to do in public on a daily basis with your continued screaming at The Fed and signing budget “deals” you said you would never do again. You’re a lying sack of **** and you along with your entire family deserve to be held personallyresponsible for each and every life you have and continue to destroy.

But in the context of State and Federal budgets, and what is driving them, when analyzed dispassionately it all comes back to one place: The Medical Monopolies.

In New York, which you just bitched about Mr. ****face (Trump), Alexa Kasdan had a cold and a sore throat. Concerned it might be strep she went to the doctor. The doc took a swab for culture and sent her out the door with a prescription. Total time in the office was likely under an hour and the amount of time the doc actually spent with her was likely measured in single-digit minutes.

Then the bill came — $28,395.50, “negotiated down” to $25,865.24, which her insurance company paid.

She was raped up the ass — an “in-network” lab would have charged $650 for all those tests, but all were medically unnecessary. Even so — $650 is a different story than $25,000, isn’t it? And guess what — the lab may well be owned by the doctor she saw. Gee, what sort of scam was that and why wasn’t said physician instantly arrested?

Oh, I know why — it makes GDP “go up” and along with it the stock market.

This is not uncommon. It used to not be uncommon in the car repair business either, up until the states started threatening to jail people for it, and now you must get and approve a written estimate before they start work. How come your so-called “price transparency” order only had a $300 fine associated with it? Why not send Bill Barr out with a fistful of indictments under 15 USC Chapter 1 instead and lock some of these **********s up in prison where they belong? You could start with all of the insurance company and health care executives at the 10 largest hospital chains in the US. By the way, that 15 USC Chapter 1 applies to the health industry has twice been confirmed by the US Supreme Court. The problem isn’t the law it’s that you love people committing felonies so long as they make the “economy” look better and stock prices soar!

The patient didn’t pay that bill personally but it doesn’t matter whether she personally paid it or not if someone pays it — and her insurance company did. Every single one of these scams, nearly all of which are felony thefts standing alone, wind up in the cost of medical care and thus medical insurance.

Health “insurance” has more than doubled since Obama was in office and so has spending on Medicare and Medicaid, which is where the entire deficit is coming from.

Last year Medicare and Medicaid spent approximately $1.576 trillion, or $1,576 billion between the two programs. In FY2008 those two programs consumed $863 billion. That is nearly a clean double.

10 years before that, in 1998, The Health Care Financing Administration, which contained both programs, spent $379 billion in total. In other words in that previous 10 years it had more than doubled again.

Guess what — during those two doublings of spending the population of 65 and older went from 31.2 million in 1990 to 35.0 million in 2000 to 40.3 million in 2010. The population of over-65 people went up by 30% during that 20 years but the spend on those two programs doubled twice; it is now 416% of what it was in 1990!

CUT THE BULL**** — THIS IS NOT ABOUT PEOPLE GETTING OLDER AND NEVER HAS BEEN. IT IS ABOUT THE MEDICAL INDUSTRY ASS-RAPING EVERY SINGLE PERSON IN THIS NATION IN A FELONIOUS MANNER, IN DIRECT VIOLATION OF 100+ YEAR FELONY CRIMINAL LAW, AND NOBODY HAS OR WILL DO A ******N THING ABOUT IT. THERE IS OVER THREE TRILLION DOLLARS STOLEN FROM THE PUBLIC BY THIS SCAM EVERY SINGLE YEAR.

If the monopolies were smashed that spending would collapse by 80%. Oh, that’s more than the deficit, isn’t it?

Guess what would happens IF we stopped all this crap, ran a surplus and outstanding debt went down? The value of everyone’s money would go up; that’s exactly identical to a raise and it’s even better than a raise in fact because an improvement in purchasing power is not taxed.

Here’s another example — this one private. A correspondent’s wife, not too long ago, had an allergic reaction to insect assault in Florida (go figure; we have biting insects.) The urgent care office charged them $125 to see her and a script for a medication to address it. The cost for the medication? $80.

This couple, incidentally told you and your MAGA bull**** to go suck a donkey off backwards and has since moved to Ecuador. Not long ago said lady was mobbed by mosquitoes again (gee, they have them there too) and guess what — they walked into a pharmacy, required no prescription, bought a tube of the same medication, labeled from the same company, but double the size for a grand total of US $4.12.

In other words in the United States she got raped for nearly 4,000% of the cost of the same drug made by the same company in the same factory compared with in places where you can’t do that, and there was no prescription required with its $125 additional******job either.

I get it that you, Donald, “love” a roaring stock market.

But the policies you and your predecessor are demanding and in fact forcing out of the Fed by running deficits of this sort, which The Fed is well aware will instantly detonate the Federal Balance sheet if rates rise to where they should be, (to be specific at least 100 basis points on the short end above the nominal GDP expansion) along with your unwillingness to lock the medical monopolists up for their rampant criminal abuse of Americans spanning decades, has turned the cities into ****holes one at a time and it’s spreading.

It’s all nice and well to blame “Democrat” policies for this Donald, but the truth is that the entirety of DC is responsible including you personally, since you and your “buddies” in Congress just passed and signed yet another unfunded set of budget bills and your spineless, felony-condoning AG Bill Barr and those in the states are directly responsible for all of this.

When, not if, it blows up you and the entirety of Congress own it ******* and I hope you and everyone associated with and related to you get it in both holes.

https://www.veteranstoday.com/2019/12/30/trumps-policies-how-america-is-being-engineered-into-mass-homelessness/

TheAltWorld

TheAltWorld

J.E.

While I am fascinated by your article, and by no means do I believe Trump is an Angel, however- why the extreme hatred?…I give you credit for blaming Obama as well..those around trump say he knows the medical system is jacked..his attempt at health care reform to me shows a sincere desire to do better, but to my untrained (in economics and health) eye it seemed that he was bulldozed by the GOP as well as the DNC..and more than likely fell into some deals himself…as D.C. is a system of interwoven skeletons in closets… I study foundations and NGO’s and look for correlation’s in crony capitalism and politics that undermines our representation and individual sovereignty. I do not want a government health care, but in studying D.C. politics it seems many laws regarding everything from antitrust laws, fed trade commission, campaign finance laws, NGO laws..in my arena of interest / have been so manipulated that the only thing left is a cesspool of politicians that are nothing more than race car drivers for racing teams….and that goes with their media too- left and right. As a conservative my desire is a fair system of capitalism in which it is the mechanism that frees us from government- but that relies on a system of government in which the checks and balances is not eroded with the same money going to both sides. I have met doctors who say entire medical companies have moved here from Germany to take advantage of the system in which there isn’t a price cap for procedures and doctor (alliances) can set a price to set the market/ which is gouged..how can Americans be educated on all forms of corruption from the medical industry into political spheres…only a focused light and an entire country upset together- can make a difference. It cannot be “left” or “right” as I believe the industry has both sides by the balls and does like other foundations- has the ability to play either angle while never getting caught in the middle. Any thoughts on where to study would be great.

Chris

Communists for over a century boasted they would destroy America via inflation and taxation. If I remember correctly, Lenin himself came up with the plan.