Moderna: A Company “In Need Of A Hail Mary”

Before COVID-19, Moderna was in danger of hemorrhaging investors, as persistent safety concerns and other doubts about its mRNA delivery system threatened its entire product pipeline. Fear caused by the pandemic crisis made those concerns largely evaporate, even though there is no proof that they were ever resolved.

Those analyzing the COVID-19 crisis and its effects have mostly focused on how its disruptive nature has led to major shifts and recalibrations throughout society and the economy. Such disruption has also lent itself to a variety of agendas that had required an event of “reset” potential in order to be realized. In the case of the vaccine industry, COVID-19 has led to dramatic changes in how federal agencies manage the approval of medical countermeasures during a declared crisis, how trials for vaccine candidates are conducted, how the public perceives vaccination, and even how the term “vaccine” is defined.

Such shifts, though obvious, have provoked praise from some and sharp criticism from others, with the latter category being largely censored from public discourse on television, in print, and online. However, in objectively analyzing such seismic changes, it’s clear that most of these shifts in vaccine development and vaccine policy dramatically favor speed and the implementation of new and experimental technology at the expense of safety and thorough study. In the case of vaccines, it can be argued that no one benefitted more from these changes than the developers of the COVID-19 vaccines themselves, particularly the pharmaceutical and biotechnology company Moderna.

Not only did the COVID-19 crisis obliterate hurdles that had previously prevented Moderna from taking a single product to market, it also dramatically reversed the company’s fortunes. Indeed, from 2016 right up until the emergence of COVID-19, Moderna could barely hold it together, as it was shedding key executives, top talent, and major investors at an alarming rate. Essentially, Moderna’s promise of “revolutionizing” medicine and the remarkable salesmanship and fund-raising capabilities of the company’s top executive, Stéphane Bancel, were the main forces keeping it afloat. In the years leading up to the COVID-19 crisis, Moderna’s promises—despite Bancel’s efforts—rang increasingly hollow, as the company’s long-standing penchant for extreme secrecy meant that—despite nearly a decade in business—it had never been able to definitively prove that it could deliver the “revolution” it had continually assured investors was right around the corner.

This was compounded by major issues with patents held by a hostile competitor that threatened Moderna’s ability to turn a profit on anything it might manage to take to market, as well as major issues with its mRNA delivery system that led them to abandon any treatment that would require more than one dose because of toxicity concerns. The latter issue, though largely forgotten and/or ignored by media today, should be a major topic in the COVID-19 booster debate, given that there is still no evidence that Moderna ever resolved the toxicity issue that arose in multi-dose products.

In this first installment of a two-part series, the dire situation in which Moderna found itself immediately prior to the emergence of COVID-19 is discussed in detail, revealing that Moderna—very much like the now disgraced company Theranos—had long been a house of cards with sky-high valuations completely disconnected from reality. Part 2 will explore how that reality would have come crashing down sometime in 2020 or 2021 were it not for the advent of the COVID-19 crisis and Moderna’s subsequent partnership with the US government and the highly unusual processes involving its vaccine’s development and approval. Despite the emergence of real-world data challenging the claims that Moderna’s COVID-19 vaccine is safe and effective, Moderna’s booster is being rushed through by some governments, while others have recently banned the vaccine’s use in young adults and teens due to safety concerns.

As this two-part series will show, safety concerns about Moderna were known well before the COVID crisis, yet they have been ignored by health authorities and the media during the crisis itself. In addition, in order to stave off collapse, Moderna must keep selling its COVID-19 vaccine for years to come. In other words, without the approval of its booster, which has caused great controversy even among the country’s top vaccine officials, Moderna faces a massive financial reckoning. While the COVID-19 crisis threw the company a lifeboat, the administration of its COVID-19 vaccine, in which the US government has now invested nearly $6 billion, must continue into the foreseeable future for the bailout to be truly successful. Otherwise, a company now worth $126.7 billion, with major investments from the US government, US military, and ties to the world’s wealthiest individuals, will crumble in short order.

A New Theranos?

In September 2016, Damian Garde, the national biotech reporter for the medical media company STAT, wrote a lengthy exposé of the “ego, ambition, and turmoil” plaguing “one of biotech’s most secretive startups.” The article focused on the company Moderna, which had been founded in 2010 to commercialize the research of Boston Children’s Hospital cell biologist Derrick Rossi. The effort to turn a profit by creating Moderna, which intimately involved controversial scientist and close Bill Gates associate Bob Langer as well as Cambridge, Massachusetts–based Flagship Ventures (now Flagship Pioneering), began soon after Rossi published a report on the ability of modified RNA to turn skin cells into different types of tissue.

Between the time of Moderna’s founding and Garde’s 2016 investigation, the buzz around Rossi’s research and its potential to create medical breakthroughs had waned, as had the buzz around its potential to make its investors very wealthy. Despite teaming up with pharmaceutical giants like AstraZeneca and raising record amounts of funding, Moderna still had no product on the market six years after its founding, and, as STAT revealed, the “company’s caustic work environment” had led to a persistent hemorrhaging of top talent, though little of its internal conflicts was publicly known due to “its obsession with secrecy.” Most troubling for the company that year, however, was that Moderna appeared to have “run into roadblocks with its most ambitious projects.”

Aside from the scientific obstacles that Moderna had encountered, one major “roadblock” for the company, per Garde, was none other than Stéphane Bancel, Moderna’s top executive, who still heads the company. According to Garde, Bancel was squarely at the center of many of the company’s controversies due, in part, to his “unwavering belief that Moderna’s science will work—and that employees who don’t ‘live the mission’ have no place in the company.” Between 2012 and 2016, Bancel was allegedly a key factor in the resignation of at least a dozen “highly placed executives,” including those who directed Moderna’s product pipeline as well as its vaccine projects.

Bancel, prior to joining Moderna, had spent much of his career in sales and operations, not science, making a name for himself at pharmaceutical giant Eli Lilly before heading a French diagnostics firm called bioMérieux. His performance there, as well as his ambition, caught the attention of Flagship Ventures, a Moderna cofounder and top investor, which then connected him with the company he would go on to lead.

Although lacking a background in mRNA and the science behind its use as a therapeutic, Bancel has made up for it by becoming Moderna’s salesman par excellence. Under his leadership, Moderna became “loath to publish its work in Science or Nature, but enthusiastic to herald its potential on CNBC and CNN.” In other words, under Bancel, the company came to promote its science through media publicity and public relations rather than by publishing actual data or scientific evidence. When two of its vaccine candidates entered phase 1 human trials in 2016 (trials that ultimately went nowhere), the company declined to list them on the public federal registry ClinicalTrials.gov. The decision not to list, which deviates from common practice by Moderna’s competitors and other more traditional vaccine companies, meant that the information on the safety of these vaccine candidates would likely never be publicly available after the trial’s conclusion. Moderna also refused to publicly comment on what diseases these vaccines were meant to target.

Such secrecy became commonplace at Moderna after Bancel took the helm, with the company having published no data “supporting its vaunted technology” by the time STAT’s 2016 exposé was published. Insiders as well as investors that had committed millions to the company were only granted “a peek” at the company’s data. According to former Moderna scientists who spoke to STAT, the company was “a case of the emperor’s new clothes.” Former employees further charged that Bancel was actually “running an investment firm” and “then hop[ing] it also develops a drug that’s successful.”

Perhaps this is why Bancel was deemed the best executive to steer Moderna. As an ambitious salesman running a highly overvalued company, he would prioritize the company’s image and its finances regardless of any issues with the science underpinning it all. Perhaps it was for that reason that Bancel, per former employees, “made it clear [from the beginning] that Moderna’s science simply had to work. And that anyone who couldn’t make it work didn’t belong.”

As STAT noted in 2016, the people who were tasked with making “the science work” were those who most frequently resigned, which led to Moderna losing two heads of chemistry within a single year, followed shortly by losing its chief scientific officer and its head of manufacturing. Many top executives, including the heads of its cancer research and rare disease research branches, ended up lasting fewer than eighteen months in their respective positions. The abrupt resignations weren’t exclusive to Moderna’s science-focused executive positions either, as the chief information officer and top financial executive role were also affected. Bancel ultimately sought advice from the human resources departments of Facebook, Google, and Netflix on employee retention.

Particularly telling was the abrupt and mysterious resignation of Moderna’s head of research and development, Joseph Bolen, after about two years at the company. A company insider at the time told STAT that the only reason Bolen would have resigned was if “there was something wrong with the science or the personnel.” In other words, Bolen either left because the science underpinning Moderna’s massive valuation did not live up to the hype or Bancel had forced him out, with the additional possibility that both were key in Bolen’s resignation.

Speculation at the time pointed the finger at Bancel, though it’s not clear why the rift between the two men emerged. Bancel asserted that he tried to convince Bolen to stay, though there were contrasting assertions from anonymous employees, and that Bolen had “voted himself off the island.”

Whatever the exact cause of the resignation of the head of R & D, it only added to the mystique around Moderna’s inner workings and its ability to deliver on its promise to “revolutionize” medicine. It also reveals more than a few similarities between Moderna and the now-disgraced company Theranos. Theranos, whose former top executive, Elizabeth Holmes, is now on trial for fraud, was known for its extreme culture of secrecy that kept investors and business partners in the dark, forced nondisclosure agreements on everyone who came in contact with the company, and kept employees “siloed” through an extremely strict need-to-know policy. Like Moderna, Theranos had been praised as revolutionary and poised to “change the medical industry forever.” Similarly, its top executive had no professional health-care or science experience, yet both fired or forced the resignations of employees who disagreed with their perspective or were unable to provide “positive” results. Both companies also failed to publish any evidence in peer-reviewed journals that the science behind their multibillion-dollar valued companies was more than just fantasy and a well-devised sales pitch.

Arguably, the most critical difference between Moderna and Theranos is that Moderna, whose numerous issues and challenges only came to light after the collapse of Theranos had begun, has never faced the same degree of scrutiny from the US government or mainstream investigative journalists. There are many possible reasons for this, including Moderna’s close relationship with the US Department of Defense through the Defense Advanced Research Projects Agency (DARPA), or concern that its exposure post-Theranos would bring scrutiny to any company existing at the intersection of Silicon Valley and the health-care industry. However, such a reckoning would likely have been inevitable for Moderna had it not been for the COVID-19 crisis, which could not have come at a more convenient time for the company.

Moderna’s “Software” Encounters Bugs

Many of the problems with Moderna that Garde identified in 2016 continued to plague the company right up until the beginning of the COVID-19 crisis. Chief among these was Moderna’s struggle to prove that its technology worked and that it was safe. Concerns about the safety and efficacy of the company’s products, which were publicly reported beginning in 2017, evaporated in the wave of panic surrounding COVID-19 and the simultaneous “Warp Speed” race for a vaccine that would “end the pandemic.” Yet, there is little, if any, evidence that these once-well-recognized concerns were addressed prior to the US government’s emergency use authorization of Moderna’s COVID-19 vaccine and its now widespread use in many countries around the world. To the contrary, there is evidence that these concerns were covered up both prior to and during the development of its vaccine.

The reports that emerged in January 2017 noted that Moderna had “run into troubling safety problems with its most ambitious therapy” and that the company was “now banking on a mysterious new technology to keep afloat.” The “ambitious therapy” in question was meant to treat Crigler-Najjar syndrome and “was to be the first therapy using audacious new technology that Bancel promised would yield dozens of drugs in the coming decade.” Bancel had specifically used the Crigler-Najjar therapy as a major selling point to investors, particularly in 2016 when he touted it at the JP Morgan Healthcare Conference.

Yet, employees of Alexion, the company co-developing the drug with Moderna, blew the whistle on the project in 2017, revealing that it “never proved safe enough to test in humans” and that the failure of this therapy and the technology platform it sought to use had been responsible for prompting Moderna to abandon the class of drug therapies that, for years, had justified its sky-high valuation and attracted hundreds of millions in investor cash.

As a result of the problem with the Crigler-Najjar drug, media outlets asserted that Moderna was now “in need of a Hail Mary” that would keep its valuation from imploding and its investors from fleeing. The persistence of problems first noted in the 2016 STAT investigation, such as Moderna’s failure to publish meaningful data supporting its mRNA technology, were only exacerbating the company’s increasingly precarious position. Indeed, not long before the indefinite delay of the Crigler-Najjar therapy, Bancel had dismissed questions about Moderna’s promise by painting mRNA as an easy way to quickly develop novel treatments for a variety of diseases. He stated that “mRNA is like software: You can just turn the crank and get a lot of products going into development.” If that were the case, why did the company have no products on the market after nearly seven years, and why had its most touted project experienced such obstacles? Clearly, in keeping with Bancel’s “software” metaphor, Moderna’s technology had encountered bugs, bugs that were potentially ineradicable.

It turns out that the Crigler-Najjar drug therapy that Moderna had bet on so heavily had failed because of the lipid nanoparticle delivery system it used to transport mRNA into cells. Crigler-Najjar had been chosen as a target condition because Moderna scientists deemed it to be “the lowest-hanging fruit.” First, the syndrome is caused by one specific genetic defect; second, the affected organ, the liver, is among the easiest to target with nanoparticles; and third and most important for the company, treating the disease with mRNA would require frequent doses, ensuring a steady stream of income for the company. Thus, given the first two motives behind the company’s focus on Crigler-Najjar, if Moderna couldn’t develop a therapy for that condition, it meant they wouldn’t be able to develop a therapy for other conditions that, for example, were caused by multiple genetic defects or affected multiple organs or those more resistant to nanoparticle-based treatments. In other words, that “Moderna could not make its therapy [for Crigler-Najjar] work” meant that it was unlikely to make therapies of that entire class work either.

Indeed, media reports on the indefinite delay of this particular therapy noted that “the indefinite delay on the [Moderna] Crigler-Najjar project signals persistent and troubling safety concerns for any mRNA treatment that needs to be delivered in multiple doses.” This issue would soon lead Moderna to only pursue treatments that could be delivered as a single dose—that is, until the emergence of COVID-19 and the advent of the COVID-19 vaccine booster debate. It is also worth mentioning that, due to the extreme rarity of Crigler-Najjar syndrome, even if the therapy had been successfully taken to market by Moderna, it would have been unlikely to bring in enough money to sustain the company.

The specific problem Moderna encountered with the Crigler-Najjar treatment was related to the lipid nanoparticle delivery system it was using. According to former Moderna employees and their collaborators at Alexion, “The safe dose was too weak, and repeat injections of a dose strong enough to be effective had troubling effects on the liver [the target organ of this particular therapy] in animal studies.” This was an issue Moderna had apparently run into with its nanoparticle delivery system in other cases too, according to reports published at the time. Per STAT, the delivery system employed by Moderna had consistently “created a daunting challenge: Dose too little, and you don’t get enough enzyme to affect the disease; dose too much, and the drug is too toxic for patients.”

Moderna attempted to offset the bad press over having to delay the Crigler-Najjar drug with claims that they had developed a new nanoparticle delivery system called V1GL that “will more safely deliver mRNA.” The claims came a month after Bancel had touted another delivery system called N1GL to Forbes. In that interview, Bancel told Forbes that the delivery system they had been using, licensed to them by Acuitas, “was not very good” and that Moderna had “stopped using Acuitas tech for new drugs.” However, as will be explored in detail in this report as well as Part II of this series, it appears that Moderna continued to rely on the Acuitas-licensed technology in subsequent vaccines and other projects, including its COVID-19 vaccine.

Former Moderna employees and those close to their product development were doubtful at the time that these new and supposedly safer nanoparticle delivery systems were of any consequence. According to three former employees and collaborators close to the process who spoke anonymously to STAT, Moderna had long been “toiling away on new delivery technologies in hopes of hitting on something safer than what it had.” All of those interviewed believed that “N1GL and V1GL are either very recent discoveries, just in the earliest stages of testing—or else new names slapped on technologies Moderna has owned for years.” All spoke anonymously due to having signed nondisclosure agreements with the company, agreements that are aggressively enforced.

One former employee, commenting on the alleged promise of N1GL and V1GL, stated that these platforms “would have to be a miraculous, Hail Mary sort of save for them to get to where they need to be on their timelines. . . . Either [Bancel] is extremely confident that it’s going to work, or he’s getting kind of jittery that, with a lack of progress, he needs to put something out there.”

It seems that those former employees who believed that N1GL and V1GL were new names put on existing technology and that Bancel was overselling their promise were correct, as Moderna appears to have returned to the troubled lipid nanoparticle delivery system it had licensed from Acuitas for subsequent therapies, including its COVID-19 vaccine. As will be explored in this report and Part II of this series, there is no evidence that Moderna ever got their “Hail Mary” save when it came to acquiring the rights for or developing a safe mRNA delivery system.

On top of the much-touted promises of N1GL and V1GL as safer treatments, Moderna additionally vowed to create “new and better formulations” for the Crigler-Najjar therapy that could potentially make it to human trials at a later time. This helped to stave off more bad press, but only for a few weeks. One month after the troubles with the Crigler-Najjar therapy were publicly reported, the head of Moderna’s oncology division, Stephen Kesley, left the company. This was just as Moderna was moving toward its first human trials for its cancer treatment, which forced “a senior leadership team with little experience in developing drugs to sort out the company’s future in the field.” Just weeks before Kesley’s departure, Bancel had boldly claimed in a bid to woo new investors at the JP Morgan Healthcare Conference, held in January 2017 in San Francisco, that oncology was Moderna’s “next big opportunity after vaccines.”

The same month as Kesley’s departure, Moderna was able to draw media attention elsewhere, as for the very first time they published data in a peer-reviewed journal. In Cell, its scientists published data on an animal trial for its Zika vaccine candidate that positively demonstrated both efficacy and safety in mice. While animal trial results do not necessarily translate into equivalent results in humans, the results were deemed to “bode well” for Moderna’s planned clinical trial of that vaccine candidate in humans. In addition, the results were like the animal trial results published by Moderna competitor BioNTech for their mRNA vaccine candidate for Zika a month earlier.

However, for Moderna, the positive news was muted by a negative ruling on a legal dispute that threatened Moderna’s ability to ever turn a profit on the Zika vaccine or any other mRNA vaccine it developed, a threat that Moderna’s competitors, such as BioNTech, didn’t have to contend with. That ruling, discussed in greater detail later in this report, greatly restricted Moderna’s use of the lipid nanoparticle delivery system licensed to it through Acuitas and directly threatened the company’s ability to create a for-profit product using intellectual property tied to the relevant patents. It would also kick off a years-long legal dispute that has suggested at various times that the promises of V1GL and N1GL were either completely invented or greatly exaggerated, as former Moderna employees and collaborators had stated.

Not long afterward, in July 2017, Moderna was hit with yet another wave of bad press as their partner in the Crigler-Najjar venture, Alexion, cut ties with the company completely. Moderna downplayed Alexion’s decision and claimed it had acquired “extensive knowledge” that would allow it to continue to develop the troubled therapy on its own. Nonetheless, Alexion’s decision came at an inopportune time for the company, as one of Moderna’s top investors had just two weeks earlier slashed its valuation of the company by almost $2 billion, allegedly because Moderna had “struggled to live up to its own hype.” Reports began to circulate claiming that “Moderna’s investors might be losing faith in the company’s future.”

Indeed, the Crigler-Najjar syndrome drug was not the only one that, at that point, had proven “too weak or too dangerous to test in clinical trials,” according to former employees and partners. The persistent issue, which again lay with the nanoparticle delivery system Moderna had licensed from Acuitas, had forced the company, beginning with the delay of the Crigler-Najjar therapy, to “prioritize vaccines, which can be dosed just once and thus avoid the safety problems that have plagued more ambitious projects.”

Yet, these single-dose “vaccines” or therapies were considered not as lucrative as the drug therapies Moderna had long promised and that underpinned its multibillion-dollar valuation, thereby forcing the company to “bet big on a loss-leader.” Also problematic was that Moderna lagged behind its mRNA vaccine competitors and that the supposed promise of its technology to produce viable vaccines was only “proven” at that point by a single, small trial. That trial, as noted by the Boston Business Journal, was an “early-stage human trial that was primarily meant to assess the safety of an avian flu vaccine.” Moderna had claimed, despite the trial being designed to assess safety, that it had “provided evidence that the vaccine is effective, with no major side effects” as well. Furthermore, as will be discussed in a later section of this report, the legal dispute over the Acuitas-licensed lipid nanoparticle system threatened Moderna’s ability to ever turn on a profit on any mRNA vaccine it managed to get through trials and the federal approval process, making the company’s future appear quite grim.

Despite Positive Press, Lingering Questions Remained

In September 2017, at a closed-door investor event meant to prevent more major investors from devaluing the company or jumping ship, Moderna provided more insight into a recently published press release on the trial results of a therapy meant to regrow heart tissue by boosting production of a protein known as VEGF. The press release, which generated positive media headlines, noted that the therapy had been proven safe in a study with a sample size of 44 patients. However, neither the press release nor the data Moderna disclosed to investors at the closed-door meeting revealed how much protein the therapy caused patients to produce, leaving its efficacy a mystery. Indeed, media reports on the investor meeting noted that “since Moderna did not release that crucial data point, outsiders can’t judge how much therapeutic potential there may be.”

The results, though they seemed to mitigate the concerns over the safety of Moderna’s technology, failed to inspire confidence in many attendees. Several attendees later told reporters that they “were not overly impressed” with Moderna’s presentation, which only “underlined lingering questions about whether it can live up to its own hype.”

One of the issues here, yet again, is that Moderna’s valuation was and is underpinned by its promise to produce products for rare diseases that require repeated injections over a patient’s lifetime. The VEGF therapy promoted by Moderna at this meeting was meant to be a one-time-only injection, and, thus, evidence of its safety did not resolve the problem of none of Moderna’s multi-dose products having proven safe enough to test on humans. The closed-door investor event made it clear that Moderna was aiming to avoid that persistent problem by prioritizing single-dose vaccines.

As STAT noted at the time:

The presentation to investors also made clear that Moderna is prioritizing vaccines. They are easier to develop from mRNA because patients need just one dose, which eliminates some of the safety issues that have plagued more ambitious projects such as therapies for rare diseases.

The pivot to vaccines remained a sore point with many investors, however, as vaccines are viewed as “low-margin product[s] that can’t generate anywhere near the profits seen in more lucrative fields like rare diseases and oncology.” These, as previously mentioned, are the very fields on which Moderna’s massive valuation had been based but for which it had been unable to produce safe and effective therapies. Moderna was clearly aware of these concerns among its current and potential investor base and attempted to speak promisingly of its oncology-related efforts at this same event. However, it was silent on trial timing and other key data points, maintaining the company’s long-standing reputation for secrecy towards both insiders and the general public. It is certainly telling that Moderna remained so secretive about key data at an event not only closed to the public and the press, but meant to reassure existing investors and to entice new ones. If Moderna declined to show important data to investors at a time when it was desperately seeking to keep them onboard, it implies that the company either had something to hide or nothing to show.

Moderna’s increasingly troubled internal situation, despite its consistently rosy PR, escalated a month later when reports emerged of the abrupt resignations of its head of chemistry, the leader of its cardiovascular division, and the head of its rare diseases division. These resignations, which occurred toward the end of 2017, followed the high-profile resignations the company suffered that were mentioned in the 2016 STAT exposé by Damian Garde.

A few months later, in March 2018, the chief scientific officer of Moderna’s vaccine business, Giuseppe Ciaramella, also left. This resignation signaled further internal troubles at the company, even more because Moderna had recently and very publicly pivoted to vaccines; and Ciaramella, in addition to leading vaccine development at this critical juncture, had been the first Moderna executive to suggest that the company’s technology could be useful in developing vaccines, a suggestion that the company was now betting everything on. One can’t help but wonder if Bancel’s tendency to force out employees and executives who “couldn’t make the science work” was a factor in any of these high-profile resignations, including that of Ciaramella.

A Years-Long Legal Snafu

Thus far, this report has largely focused on how Moderna’s extreme secrecy appears to have been used to obfuscate and mitigate major issues with its technology and product pipeline and how those issues were reaching a climax following the company’s IPO and immediately prior to the COVID crisis. However, the challenge of creating products that work and can be proven to work in clinical settings is but one of at least two major issues facing Moderna as a company. Indeed, during the same timetable explored above, Moderna was embroiled in aggressive disputes related to intellectual property and patents. Notably, these same legal issues deal with the lipid nanoparticle system that was also reportedly at the root of Moderna’s safety and product-pipeline issues.

As mentioned earlier, the lipid nanoparticle delivery system used in many Moderna therapies was licensed to them by Acuitas. Acuitas, however, had licensed that system from a separate company, Arbutus, which sued in 2016 claiming that Acuitas’s sublicense to Moderna was illegal. Arbutus won the case, which lead to a temporary injunction in 2017 that stopped Acuitas from further sublicensing the lipid nanoparticle technology. A settlement reached between Acuitas and Arbutus in 2018 terminated Acuitas’s license and restricted Moderna’s use of the technology to four vaccine candidates that targeted already identified viruses.

Moderna’s Bancel told Forbes in 2017 that the Acuitas/Arbutus system was barely mediocre and that Moderna was developing its own improved delivery system that would not infringe on Arbutus’s intellectual property (the aforementioned N1GL and V1GL systems). However, soon after Bancel made those claims, Arbutus’s leadership challenged them, stating that the company had reviewed all of Moderna’s patents, publications, and presentations regarding these “new” delivery systems and had found nothing that didn’t involve their own intellectual property. Even former Moderna employees, as mentioned previously, were very doubtful that N1GL and V1GL were any different than the Acuitas/Arbutus system, meaning that—despite Bancel’s claims—Moderna had unresolved legal woes related to these nanoparticles that, along with the toxicity issues, was stalling Moderna product candidates.

It is important to note at this point that, while only Moderna has been locked in a legal battle with Acuitas/Arbutus for years over LNP intellectual property, the other main producers of mRNA COVID-19 vaccines, Pfizer/BioNTech and CureVac, also use major aspects of the same Arbutus-derived technology. However, BioNTech licensed the LNPs in such a way as to avoid the issues that have entangled Moderna for years.

Moderna’s legal dispute, in addition to the already discussed safety issues, greatly threatened Moderna’s ability to survive as a company. Having already been forced to settle on the vaccines market and reject the more lucrative and “revolutionary” mRNA therapies it had long promised, Moderna was steadily moving toward a position where it had “no right to sell” vaccine products that depended on the Arbutus-patented and Acuitas-sublicensed technology. This situation has placed pressure on Moderna to negotiate a new license with Arbutus directly, negotiations in which the company would have very little leverage.

Since the first legal case in 2016, Moderna and Arbutus have remained locked in disputes about the nanoparticles and who owns them. Moderna challenged three Arbutus patents with the US Patent and Trademark Office, with mixed results. Yet, simultaneously, Moderna also claimed that its tech was “not covered by the Arbutus patents,” which prompted numerous observers and reporters to ask questions such as—“In that case, why did [Moderna] initiate the legal action against Arbutus to begin with?”

Moderna answered that query by claiming that it targeted Arbutus only because of Arbutus’s past “aggression” against them. However, despite such claims, the effort and cost inherent in the legal challenge reveals that, at the very least, Moderna takes the threat of Arbutus’s intellectual property claims very seriously. The actual answer seems to lie in Moderna being willing to publicly claim that their LNP technology is different enough from the Arbutus-derived system covered by the patents but unwilling to release any proof—whether in court, to its own investors, or to the public—that it is in fact different. The more recent twists and turns of this protracted legal battle, including a pivotal 2020 decision that was very unfavorable for Moderna, are discussed in Part II of this series.

Anything to Aid a Slumping Stock Price

Just previous to Ciaramella’s resignation, Moderna had claimed to have “solved the scientific issues that made its earlier mRNA treatments too toxic for clinical trials,” according to media reports. Those reports also claimed that, as a result, “Moderna believes it has steered back on course,” though the company did not provide evidence to support that claim. Nevertheless, the promise allowed the company to complete a new round of financing, during which it raised an additional $500 million from “an investor syndicate uncommon in biotech” that included the governments of Singapore and the United Arab Emirates. Some observers were puzzled as to how Moderna had managed to raise so much money despite the outstanding questions about the science underpinning its high valuation.

The answer came with the publication of Moderna’s confidential investor slide deck by STAT’s Damian Garde, which showed that the company had predicted that drugs that they had only been tested in mice would soon be worth billions and that its vaccine revenue would amount to $15 billion annually. The slide deck, deemed “pretty absurd” and “geared at hopeful generalists that can dream big” per one skeptical investor, made it clear why the company’s last funding round had appealed to “unconventional” biotech investors rather than veteran investors focused on the industry. A veteran biotech investor, who spoke anonymously due to the slide deck’s confidentiality, stated that “it’s a deck designed to tell the ‘we’re going to be huge’ story to a group of rather unsophisticated investors—and it does that beautifully. . . . Just enough science and platform stuff to convey the ‘We know what we’re doing’ sentiment, but not enough to engender technical questions.”

Per those who sat through Moderna’s pitch, the company was “very generous on the market-size assumptions for their programs,” with one former Moderna collaborator placing the real-world value of a treatment the company had claimed was worth billions annually at closer to “$100 million to 250 million.” Of course, that revenue estimate comes with the caveat that the treatment, tested thus far only in mice, would someday prove to work in humans. A former Moderna employee in its rare diseases division stated at the time that Moderna “continue[s] to rush forward and over-promise the potential for broad use of mRNA prior to any evidence beyond vaccines or very early experiments in mice.”

Despite Moderna’s ability to convince “unsophisticated” and/or “unconventional” investors to back its early 2018 funding round, it appears that one of its most important promises used to attract investors—that it had solved the nanolipid particle toxicity issue—was not true.

In a filing with the Securities and Exchange Commission dated November 2018, months after Moderna had claimed to have fixed the issues with its lipid nanoparticle delivery system, the company made several claims that appear to contradict its purported development of a new, safer nanoparticle technology.

For example, the filing states on page 33:

Most of our investigational medicines are formulated and administered in an LNP [lipid nanoparticle] which may lead to systemic side effects related to the components of the LNP which may not have ever been tested in humans. While we have continued to optimize our LNPs, there can be no assurance that our LNPs will not have undesired effects. Our LNPs could contribute, in whole or in part, to one or more of the following: immune reactions, infusion reactions, complement reactions, opsonation [sic] reactions, antibody reactions including IgA, IgM, IgE or IgG or some combination thereof, or reactions to the PEG from some lipids or PEG otherwise associated with the LNP.

Certain aspects of our investigational medicines may induce immune reactions from either the mRNA or the lipid as well as adverse reactions within liver pathways or degradation of the mRNA or the LNP, any of which could lead to significant adverse events in one or more of our clinical trials. Many of these types of side effects have been seen for legacy LNPs. There may be resulting uncertainty as to the underlying cause of any such adverse event, which would make it difficult to accurately predict side effects in future clinical trials and would result in significant delays in our programs. (emphasis added)

Based on these statements, Moderna appeared to be uncertain as to whether its current lipid nanoparticle delivery system was any safer than that which led to the indefinite delay of its Crigler-Najjar therapy. In addition, the reference to “adverse reactions within liver pathways,” one of the main issues that triggered the specific delay of the Crigler-Najjar therapy, suggests a continued reliance on technology sublicensed from Acuitas. As will be noted in Part II, the Moderna COVID-19 vaccine also appears to use the controversial Acuitas technology that had prompted significant safety, legal, and financial concerns for Moderna for years.

The November 2018 SEC filing makes other statements regarding its supposedly fixed lipid nanoparticle delivery system that are worth noting:

If significant adverse events or other side effects are observed in any of our current or future clinical trials, we may have difficulty recruiting trial participants to any of our clinical trials, trial participants may withdraw from trials, or we may be required to abandon the trials or our development efforts of one or more development candidates or investigational medicines altogether. . . .

Even if the side effects do not preclude the drug from obtaining or maintaining marketing approval, unfavorable benefit risk ratio may inhibit market acceptance of the approved product due to its tolerability versus other therapies. Any of these developments could materially harm our business, financial condition, and prospects.

These statements are significant in that they openly suggest at least one reason for Moderna’s long-standing tendency toward secrecy in publishing data about its treatments, as public knowledge of its technology’s persistent challenges would threaten its ability to attract trial participants, investors, and, later, consumers.

About a month after these troubling admissions were made in fine print, Moderna succeeded in pulling off a record-setting initial public offering (IPO) in December 2018. For that IPO, Moderna had retained the services of eleven investment banks, which is reportedly around “twice the number normally seen in biotech offerings.” However, its stock value tumbled just hours afterward, “a sign the company and its underwriters might have over-estimated demand for the richly valued company.” A month after the IPO, Moderna’s stock continued its downward slide, “doing exactly the opposite of what private investors look for in an IPO.” Those who had predicted this post-IPO outcome before Moderna went public had also warned that this downward trend would likely continue through early 2020 if not longer. Skeptics such as STAT’s Damian Garde had warned right before Moderna’s IPO that that the company’s sliding stock value would likely continue throughout 2019 due to “a seeming lack of impending news,” given that “momentum in biotech, positive or negative, is driven by catalysts” and “Moderna is in for a fairly quiet 2019.”

Meanwhile, media reports warned, as they had for years, that Moderna “is still in the early days of proving [their] technology’s potential,” despite being a nine-year-old company. Such reports also noted that Moderna’s inability to prove its technology’s worth after nearly a decade in business was hampered by its “struggl[e] in its initial efforts to turn mRNA into drugs that can be repeatedly dosed, leading it to pivot to vaccines, which can be administered just once or twice.” Investors at the 2019 JP Morgan health-care conference spoke of concerns that “Moderna [has] yet to rule out the lingering risks tied to mRNA, and, even at its depressed valuation, the company is simply too expensive.” Others confided in reporters that they would be “sitting on the sidelines until Moderna either changes the narrative with promising human data or gets substantially cheaper.”

A few weeks later, Moderna’s Bancel attended the World Economic Forum’s 2019 annual meeting alongside Johnson & Johnson executive Paul Stoffels and other pharmaceutical and biotech leaders in order to “rub elbows with world leaders and one-percenters—and talk about the future of healthcare.” Other health-care figures in attendance included head of the World Health Organization, Tedros Adhanom Ghebreyesus, and “global health philanthropist” Bill Gates, whose foundation entered into “a global health project framework” with Moderna in 2016 to “advance mRNA-based development projects for various infectious diseases.” The Bill & Melinda Gates Foundation is the only foundation listed as a “strategic collaborator” on the Moderna website. Other “strategic collaborators” include the US government’s Biomedical Advanced Research and Development Authority (BARDA), the US military’s DARPA, and pharmaceutical giants AstraZeneca and Merck.

Moderna first teamed up with the WEF just a few years after its founding back in 2013, when it was named to the Forum’s community of Global Growth Companies (GGC). That year, Moderna was one of just three North American health companies to receive the honor and was additionally recognized by the Forum as “an industry leader in innovative mRNA therapeutics.” “We are honored to be recognized for our efforts to advance our platform and ensure its potential is realized on a global scale, and we look forward to being a member of the World Economic Forum community,” Bancel said at the time.

As a WEF Global Growth Company, Moderna has closely and regularly engaged with the Forum since 2013 at both the Chinese-hosted Annual Meeting of the New Champions and the WEF’s regional meetings, while also having access to the WEF’s exclusive networking platform that provides the company privileged access to the world’s most powerful business and government leaders. Additionally, such carefully selected companies are given opportunities by the Forum “to shape global, regional and industry agendas and engage in meaningful exchanges about ways to continue on a sustainable and responsible path of growth.” Essentially, the roster of such companies constitutes a consortium of corporations that are promoted and guided by the Forum because of their commitment to “improving the state of the world,” that is, their commitment to supporting the Forum’s long-term agendas for the global economy and for global governance.

In April 2019, Moderna published some information on modifications to its lipid nanoparticles (discussed in more detail in Part II). A month later, in May 2019, Moderna published positive results in the journal Vaccine for phase 1 data on mRNA vaccine candidates for “two potential pandemic influenza strains” administered as two doses three weeks apart. The company’s press release on the study stated that “future development of Moderna’s pandemic influenza program is contingent on government or other grant funding,” suggesting that it would use the trial results to lobby the government for funds for a continuation of this particular program.

Notably, at the same time as these results were published, the US Department of Health and Human Services Office of the Assistant Secretary for Preparedness and Response, then filled by Robert Kadlec, was in the midst of conducting Crimson Contagion, a multimonth simulation of a global pandemic involving an influenza strain that originates in China and spreads globally through air travel. The strain at the center of the simulation, called H7N9, is one of the very strains used in the Moderna study. Moderna published those results on May 10, just four days before the Crimson Contagion simulation hosted its federal interagency seminar. BARDA, which the ASPR office oversees, is a major strategic ally of Moderna and was co-developing these “potential pandemic influenza” vaccines that are mentioned in this timely press release, that is, for H10N8 and H7N9 influenza infections.

Crimson Contagion is notable for several reasons, most significantly for Kadlec’s own history with the Dark Winter simulations that preceded and eerily predicted the 2001 anthrax attacks. As has been discussed in detail in a previous TLAV – Unlimited Hangout investigation, the 2001 anthrax attacks conveniently rescued anthrax vaccine manufacturer BioPort, now Emergent Biosolutions, from certain ruin, much like the way the COVID crisis did for Moderna.

A month later, in June 2019, Moderna again managed to generate positive headlines on making its debut at the American Society of Clinical Oncology annual meeting, where it sought to promote its ability to produce the personalized cancer treatments that had been key to wooing investors both before and after its record-setting IPO. It was the first time the company had publicly presented data on a cancer treatment, and this particular treatment was being co-developed with Merck. The data showed positive results in preventing relapses in cancer patients whose solid tumors had been removed via surgery, but the trial failed to show any definitive effect in cancer patients whose tumors had not been removed. Thus, the early data seemed to indicate that Moderna’s treatment would only help cancer patients stay in remission after other medical interventions had been performed. Though the news allowed Moderna to bask in some much-needed positive press and to promote its oncology products in development, some reports rightly noted that it was “still too early for any definitive judgment” on the cancer treatment’s clinical benefit.

Despite this apparent advance, by September 2019, Moderna’s stock price continued to decline, leading to a loss of about $2 billion in market value from the company’s $7.5 billion valuation at the time of its record-setting IPO. The main factors for this were the same persistent problems the company had been facing for years—lack of progress, including lack of products on the market; persistent safety problems with its mRNA technology; and the lack of data showing that advances were being made to make that technology commercially feasible.

In mid-September 2019, Moderna gathered investors together to showcase scientific evidence it claimed would finally prove that its mRNA technology could “turn the body’s own cells into medicine-making factories” and hopefully “turn skeptical investors into believers.” This data, which was derived from a very preliminary study that involved only four healthy participants, had complications. Three of the four participants had side effects that prompted Moderna to state at the meeting that they would need to reformulate the mRNA treatment to include steroids, while one of the participants suffered heart-related side effects, including a rapid heart rate and an irregular heartbeat. Moderna, which asserted that none of the heart-related side effects was serious, could not “definitively pinpoint the cause of the heart symptoms.” Yet, as previously mentioned, it was likely related to the safety issues that had been plaguing its experimental products for years.

The company’s preliminary data, which was promoted in yet another bid to keep investors from leaving, also included the caveat that Moderna had decided to pause trials for this particular product, which was a single-injection mRNA treatment for the chikungunya virus. That treatment was being developed in partnership with the Pentagon’s DARPA. Other more positive data from a preliminary trial were also released at this meeting. That trial, however, was for an mRNA treatment for cytomegalovirus, “a common virus that is usually kept in check by the body’s immune system and rarely causes problems in healthy people,” meaning its mRNA vaccine for that condition was unlikely to ever be lucrative.

Not long after this lackluster investors meeting, on September 26, 2019, the once highly secretive Moderna announced it would collaborate with researchers at Harvard University “in hopes that the research will spur new drugs,” as its product pipeline appeared to have stalled. Moderna president Stephen Hoge described the collaboration as select Harvard researchers receiving “a package of stuff that we put our blood, sweat, and tears in, and then someone’s going to do something with it. We’ll find out afterward how that went.” For a company long known for its extreme secrecy in an already secretive industry, Moderna’s arrangement with Harvard, which it admitted was “unusual,” came across as somewhat desperate.

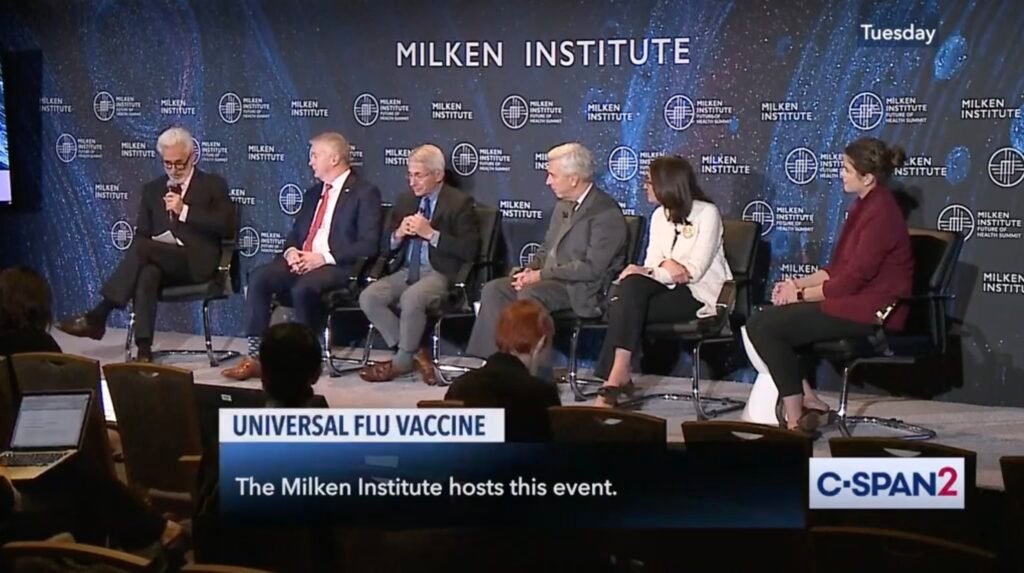

A month later, at the 2019 Milken Institute Future of Health Summit, there was a panel discussion on universal flu vaccines and how a “disruptive” event would be needed to upset the long-existing bureaucratic vaccine-approval process to facilitate wider adoption of “nontraditional” vaccines, such as those produced by Moderna. Panel speakers including former FDA commissioner Margaret Hamburg, a veteran of the 2001 Dark Winter exercise and scientific advisor to the Gates foundation, as well as Anthony Fauci of the National Institutes of Health’s National Institute of Allergy and Infectious Diseases (NIAID) and Rick Bright of BARDA, who previously worked for the Gates-funded PATH. The panel discussion notably took place shortly after the controversial coronavirus pandemic simulation called Event 201, whose moderators and sponsors had been intimately involved in 2001’s Dark Winter.

During the panel, the moderator—Michael Specter of the New Yorker—asked the question: “Why don’t we blow the system up? Obviously, we just can’t turn off the spigot on the system we have and then say ‘Hey! everyone in the world should get this new vaccine we haven’t given to anyone yet,’ but there must be some way.” Specter then mentioned how vaccine production is antiquated and asked how sufficient “disruption” could occur to prompt the modernization of the existing vaccination development and approval process. Hamburg responded first, saying that as a society we are behind where we need to be when it comes to moving toward a new, more technological approach and that it is now “time to act” to make that a reality.

Several minutes later, Anthony Fauci stated that the superior method of vaccine production involves “not growing the virus at all, but getting sequences, getting the appropriate protein and it sticking in on self-assembling nanoparticles,” essentially referring to mRNA vaccines. Fauci then stated: “The critical challenge . . . is that in order to make the transition from getting out of the tried and true egg-growing [method] . . . to something that has to be much better, you have to prove that this works and then you have got to go through all of the critical trials—phase 1, phase 2, phase 3—and show that this particular product is going to be good over a period of years. That alone, if it works perfectly, is going to take a decade.” Fauci later stated that there is a need to alter the public’s perception that the flu is not a serious disease in order to increase urgency and that it would be “difficult” to alter that perception along with the existing vaccine development and approval process unless the existing system takes the posture that “I don’t care what your perception is, we’re going to address the problem in a disruptive way and an iterative way.”

During the panel, Bright stated that “we need to move as quickly as possible and urgently as possible to get these technologies that address speed and effectiveness of the vaccine” before discussing how the White House Council of Economic Advisers had just issued a report emphasizing that prioritizing “fast” vaccines was paramount. Bright then added that a “mediocre and fast” vaccine was better than a “mediocre and slow” vaccine. He then said that we can make “better vaccines and make them faster” and that urgency and disruption were necessary to produce the targeted and accelerated development of one such vaccine. Later in the panel, Bright said the best way to “disrupt” the vaccine field in favor of “faster” vaccines would be the emergence of “an entity of excitement out there that’s completely disruptive, that’s not beholden to bureaucratic strings and processes.” He later very directly said that by “faster” vaccines he meant mRNA vaccines.

The Bright-led BARDA and the Fauci-led NIAID in just a few months’ time became the biggest backers of the Moderna COVID-19 vaccine, investing billions and co-developing the vaccine with the company, respectively. As will be explained in Part II of this series, the partnership between Moderna and the NIH to co-develop what would soon become Moderna’s COVID-19 vaccine was being forged as early as January 7, 2020, long before the official declaration of the COVID-19 crisis as a pandemic and before a vaccine was proclaimed as necessary by officials and other individuals. Not only did the COVID-19 vaccine quickly become the answer to nearly all Moderna’s woes but it also provided the disruptive scenario necessary to alter the public’s perceptions of what a vaccine is and eliminate existing safeguards and bureaucracy in vaccine approval. (Watch the 2019 Universal Flu Vaccine event here.)

As Part II of this series will show, it was an alleged mix of “serendipity and foresight” from Moderna’s Stéphane Bancel and the NIH’s Barney Graham that propelled Moderna to the front of the “Warp Speed” race for a COVID-19 vaccine. That partnership, along with the disruptive effect of the COVID-19 crisis, created the very “Hail Mary” for which Moderna had been desperately waiting since at least 2017 while also turning most of Moderna’s executive team into billionaires and multi-millionaires in a matter of months.

However, Moderna’s “Hail Mary” won’t last – that is, unless the mass administration of its COVID-19 vaccine becomes an annual affair for millions of people worldwide. Even though real-world data since its administration began challenges the need for as well as the safety and efficacy of its vaccine, Moderna – and its stakeholders – cannot afford to let this opportunity slip through fingers. To do so would mean the end of Moderna’s carefully constructed house of cards.

https://unlimitedhangout.com/2021/10/investigative-reports/moderna-a-company-in-need-of-a-hail-mary/

Author’s Note: Dr. Michael Palmer, Dr. Meryl Nass and Catherine Austin Fitts contributed much-appreciated feedback and guidance on this article. Special thanks to Katy M. for copy-editing help.

TheAltWorld

TheAltWorld

One thought on “Moderna: A Company “In Need Of A Hail Mary””