“The Owner”: The Rise of Eduardo Elsztain and the Coming End of Argentina’s Democracy

- Whitney Webb

- Friday 5 Apr 19

- 2428

- 0

With the backing and funding of the global elite, Eduardo Elsztain and his closest associates have taken control of Argentina’s real estate, electricity, agriculture, and finance industries. His next target? Argentina’s election system.

It seemed like a longshot, but anything was possible in the mind of an ambitious, 30-year-old Eduardo Elsztain. Elsztain, then living in New York, had landed a meeting with the wealthy Hungarian-American financier George Soros, a meeting that the bulk of media reports covering Elsztain’s rise to prominence claim was arranged purely by chance. Though Elsztain was inexperienced and unknown at the time, Soros saw something he liked in the ambitious Argentine, so much so that he gave him $10 million without a second thought.

According to Elsztain’s recollection, “We talked for an hour or so, and then he asked how much money I thought I could handle. I told him I could manage $10 million.” Soros, as Elsztain remembers it, simply said “Okay, no problem.” Soros later explained his seemingly impulsive investment by saying that Elsztain “knew when to sell and when to buy.”

Soros’ investment not only changed Elsztain’s fate, but Argentina’s. With that $10 million in newly secured funding, Elsztain and his close associate Marcelo Mindlin transformed Elsztain’s grandfather’s company Inversiones y Representaciones S.A. (“Investments and Brokerage, Inc.”, better known by its Spanish acronym IRSA) into Argentina’s largest business empire. Indeed, through IRSA, Elsztain has become not only the country’s largest landowner and real estate developer, but also the dominant force in the country’s massive beef and agriculture industry, its gold mining industry, and its banking system. As a result, he has been dubbed by the Argentine press as simply “The Landowner.”

In recent years, Elsztain’s business empire has extended far beyond South America and into Israel, where he owns the majority stake in one of Israel’s largest conglomerates, IDB, as well as important stakes in several other notable Israeli companies. Israeli media frequently refers to Elsztain as “South America’s richest Jew.” These business interests have made him one of the most powerful oligarchs in both Argentina and the Zionist state.

Yet — muh like British billionaire Joe Lewis, whose activities in Argentina are described in detail in Part I of this series — a litany of crimes, schemes and conspiracies lie beneath Elsztain’s sprawling business empire and his carefully crafted image of a “self-made man” devoted to Jewish charity and religious causes. Notably, Elsztain’s massive business empire is also connected to that of Lewis through Elsztain’s longtime associate and partner Marcelo Mindlin, who co-owns Argentina’s largest private power company with Lewis.

Yet, while Elsztain and Mindlin are supremely powerful and influential in their own right, they often act as the Argentine faces for policies promoted by the global oligarchy, to which they are both well connected. Indeed, Elsztain and Mindlin are connected to elite groups managed by well-known and controversial billionaire families like the Rockefellers, Rothschilds and Bronfmans, through their membership and leadership roles in groups like the Council of the Americas as well as powerful international Zionist organizations.

These connections to global oligarchy and global Zionism have recently prompted Elsztain to orchestrate a policy that, if enacted, would utterly gut Argentina’s democracy and would amount to a “bloodless coup” of a country that has long been in the sights of the global elite.

This article is Part II of a multi-part investigative series examining the efforts of the global elite, as well as powerful elements of the global Zionist lobby and the government of Israel, to create an independent state out of Argentina’s southern Patagonia region in order to plunder its natural resources and to fulfill long-standing Zionist interest in the territory that dates back to the “founding father” of Zionism, Theodore Herzl. Part I, which focuses on the de facto “parallel state” created by British billionaire Joe Lewis in Argentina’s Patagonia, can be read here. Part II focuses on Eduardo Elsztain — one of Argentina’s wealthiest businessmen, who is deeply connected to the global elite and global Zionist lobbies — and his role in a scheme to undercut Argentina’s democracy by hijacking its voting system.

Starting “small,” Elsztain gets “golden advice”

Inversones y Representaciones S.A. (IRSA), now Argentina’s largest real estate company, had humble beginnings, growing slowly after its founding in 1943 by Eduardo Elsztain’s grandfather Isaac Elsztain, a Russian-Jewish immigrant who arrived in Argentina in 1917. After his uncle’s unexpected death in 1981 and soon after Elsztain had returned from a year abroad in Israel, Elsztain took over the management of the firm, dropping out of university to do so.

When Elsztain took over most of IRSA’s management, the firm was struggling and worth barely $100,000. In order to buy IRSA shares and definitively take control of the company, Elsztain turned to his friend Marcelo Mindlin, borrowing $120,000 from him to buy stock in the company. The Mindlin-Elsztain partnership would turn spectacularly lucrative and was once called “one of the most successful business marriages of menemismo,” a reference to the presidency of Carlos Menem that oversaw the privatization wave of the 1990s.

However, it was not until Elsztain’s fateful meeting with Soros that IRSA was to become the behemoth it is today, now valued at $11.6 billion. Yet, there was another meeting that also helped Elsztain secure his future fortune, one that has received decidedly less coverage.

While he lived in New York from 1989 to 1990, prior to meeting Soros, Elsztain made another “life changing” meeting, with the Lubavitcher Rebbe, Menachim Mendel Schneerson of the New York-based Chabad-Lubavitch movement, often simply referred to as Chabad. Chabad is arguably one of the most influential Orthodox, Hasidic Jewish organizations at the international level — the Times of Israel once called it “one of the most powerful forces in world Jewry” — and Schneerson was its most prominent and final leader.

Schneerson has been touted by followers as a “prophetic visionary and pragmatic leader, synthesizing deep insight into the present needs of the Jewish people with a breadth of vision for its future,” who also “charted the course of Jewish history” in the post-World War II era. Among other things, Schneerson controversially taught that “the entire creation [of a non-Jew] exists only for the sake of the Jews” and was implacably hawkish in regards to Israel’s military occupation of Palestine.

Elsztain himself has characterized his meeting with Schneerson as being equally, if not more, important to his future business success as his meeting with Soros. According to an account of the meeting published in Haaretz, “the rabbi advised him to sell his holdings on the stock exchange and focus on real estate, a suggestion that turned out to be well timed.” Haaretzconcluded that the “success of the Lubavitcher Rebbe’s golden advice is possibly what drives Elsztain today.”

Elsztain’s deep ties to the Chabad movement, as well as the long-standing interests in Argentina of Zionists within and outside of Chabad — particularly regarding control of the country’s land and resources, with an emphasis on Patagonia — will be discussed in detail in a subsequent installment of this series. For now, it is worth noting that Chabad’s website statesthat Elsztain “is honorary president of Chabad of Argentina, and in that capacity has been a crucial partner for all Chabad activities in the country and even globally.”

Another important point regarding the beginnings of IRSA, and with it Elsztain and Mindlin’s sprawling business empire, is what really inspired George Soros to part with $10 million during that “happenstance” meeting with a young Argentine of no renown. Though the official story goes that Elsztain secured his meeting with Soros purely by chance, Argentine newspaper La Nación has revealed that this is merely a myth that has been used to create the impression that Elsztain’s fortune was “self-made.”

Indeed, despite the “legend” that Elsztain’s core business IRSA has tirelessly promoted of a “chance” Soros meeting, La Nación — one of Argentina’s most prestigious papers — wrote:

The real story is a bit less spectacular. Elsztain found himself face to face with Soros thanks to his contacts that he had been developing inside the Jewish community in Buenos Aires, who were responsible for opening the doors of the powerful businessman [to Elsztain].”

Another myth involves the claim that Soros was making a personal investment in Elsztain specifically. Instead, as a 1998 New York Times article reveals, Elsztain — during that fateful meeting — persuaded Soros to drop $10 million, not on IRSA or his own financial brilliance per se, but after convincing him “that new policies of the Argentine government intended to deregulate and privatize the economy were worth a gamble.” In fact, Soros had seen an opportunity not necessarily in Elsztain as an individual, but rather to plunder Argentina’s public resources via the coming wave of privatization.

Frontmen for the “free-enterprise” revolution

Soros — through his powerful connections to the international global elite and multinational corporations — was able to ensure that several lucrative privatizations fell into his lap. Elsztain and his partner Marcelo Mindlin as well became top beneficiaries of this crony capitalism as a result of their role as Soros’ Argentine frontmen for the duration of their decade-long partnership. By the time the partnership ended, at least publicly, in the early 2000s, Soros made at least $500 million in profits from his investments in partnership with Elsztain and Mindlin.

Argentine president Cristina Kirchner during a 2014 meeting with George Soros in New York. Photo | Reuters

Indeed, after just eight years of “Menemismo,” Elsztain and his associates, including his brother Alejandro and Mindlin, had become “the darlings of Wall Street’s emerging-market gurus and Argentina’s free-enterprise revolutionaries.” Elsztain and Mindlin currently continue this role as frontmen but, after outgrowing Soros in the early 2000s, became Argentine frontmen for the global elite — even after splitting up their legendary partnership, as will be described in a subsequent section of this article.

After Domingo Cavallo, a Harvard-educated economist who served as president of Argentina’s Central Bank during the country’s military dictatorship, became economy minister in 1991 during Carlos Menem’s first presidential term, a wave of privatizations took place that were intended to align Argentina with the so-called “Washington Consensus” promoted by the George H.W. Bush administration. Many of those privatizations were handled by just a handful of law firms, one of which was Zang, Bergel and Viñes.

As researcher and author Fabian Spollansky has noted, Zang, Bergel and Viñes was “one of the motors of the great privatization machine” and, having been hired as “consultants” by the Menem-led government, helped oversee the privatizations of key state assets, including Córdoba Waters (Aguas de Córdoba) and state oil company YPF. During many of these privatizations, two of the firm’s partners, Saúl Zang and Ernesto Viñes, were also working for IRSA — then run by the partnership formed by Elsztain, Mindlin and Soros — and Elsztain was among the firm’s top clients.

The overlap generated many conflicts of interest, particularly in the privatization of the National Savings and Insurance Bank (Caja Nacional de Ahorro y Seguro), in the course of which Zang, Bergel and Viñes’ consultant contract with the government was canceled when it was revealed that the firm sought to sell the firm to Elsztain, who was also a client of the firm and employing Zang and Viñes separately through IRSA. This bank, now known as Caja S.A., was instead privatized and sold off to an Italian company and Argentina’s Werthein Group. The Wertheins are closely linked to Elsztain through their leadership roles in the international Zionist organization the World Jewish Congress, and their ties to Elsztain will be expanded upon in a forthcoming installment of this series.

Starting in 1987, the World Bank began to lobby Argentina’s government, then led by Raúl Alfonsín, to either privatize or close Banco Hipotecario Nacional, or the National Mortgage Bank, which was dramatically restructured in 1992 under Menem’s presidency. The bank had traditionally been used to provide extended, low-interest loans to Argentines, particularly those of lower income, and to finance the construction of both private and public works. Despite the World Bank’s efforts, the bank’s executives and employees, along with many Argentines, strongly resisted privatization efforts.

As a consequence, under the presidencies of Alfonsín and his successor Carlos Menem — whose policies, along with those of his economy minister, Domingo Cavallo, were found to have been directly responsible for the collapse of Argentina’s economy in the early 2000s — the bank underwent a “deep restructuring” that led it to dramatically reduce its staff, resulting in the closure of around 60 percent of its total branches. In addition, according to author and researcher Fabián Spollansky, the state-run bank’s coffers were manipulated for a variety of purposes that ultimately — and, as Spollansky argues, intentionally — resulted in a major crisis at the bank that led to its transformation into a wholesale bank in 1992 and to the appointment of Pablo Espartaco Rojo as its president in 1994. Espartaco Rojo had been serving as sub-secretary of deregularization and economic organization of the economy ministry, headed by Domingo Cavallo, prior to taking over control of the bank.

Espartaco Rojo spent his time as the bank’s top executive paving the way for the bank’s eventual privatization in 1997, when Elsztain’s IRSA became the top shareholder in the bank, after paying $1.2 billion that came not from IRSA but from George Soros. The price to buy the bank was astoundingly low considering that the bank’s value, according to Espartaco Rojo, was much higher — and as high as $6 billion according to some. Notably, one of the consultants hired by Espartaco Rojo to aid in the bank’s privatization process was Zang, Bergel and Viñes.

As president of the bank, Espartaco Rojo had sold the bank’s privatization to the country and to its Congress by asserting that he would receive, at minimum, $3 billion for the bank’s privatization, funds that would then be placed in a new Federal Fund for Regional Infrastructure that would finance the building of public works throughout the country — a promise that was never fulfilled, as only $1.2 billion was received and the fund did not build any public works.

Overseeing the privatization, along with Espartaco Rojo, was then-Economy Minister Roque Fernández, a neoliberal “Chicago Boy” who was also a former World Bank and IMF official. Calls were later made to investigate Fernández and Espartaco Rojo and other parties involved in the “highly irregular” privatization of the bank, but went nowhere. One of the key people accused of involvement in illegal activities that led to the bank’s privatization is Daniel Marx, who was chief negotiator of Argentina’s external debt from 1989 to 1993 and is closely linked to the global financial elite through his investment bank, Quantum Finanzas.

After the privatization, Espartaco Rojo stayed on as the bank’s president until 2000. The president of the bank after Espartaco Rojo was Miguel Kiguel who had been undersecretary of finance and chief advisor to the minister of the economy of Argentina under Menem and, most crucially, chief economist at the World Bank at the very time that the World Bank was pressuring Argentina’s government to privatize Banco Hipotecario.

After the bank’s privatization, many of Elsztain’s associates were rewarded with positions on the bank’s board, including Saúl Zang and Ernesto Viñes, as well as Mario Blejer, who is the bank’s vice president. Blejer was a senior adviser to the IMF for decades, as well as a former president of Argentina’s Central Bank. As president of the Central Bank, he attempted to force the dollarization of the Argentine economy during its collapse and debt default, a crisis engineered by Menem and Cavallo’s policies. Blejer is also a long-time associate of Elsztain and a member of IRSA’s board of directors, as well as a former adviser to the Bank of England, and was considered a front-runner to head Israel’s Central Bank in both 2013 and 2018.

Another notable director at the bank was Jacobo Julio Driezzen, former alternate executive director of the IMF, sub-secretary of finances at the Economy Ministry during the lead-up to Argentina’s economic collapse, and executive director of Galicia Capital Markets, a subsidiary of Banco Galicia, one of Argentina’s largest private banks.

As will be shown in an upcoming article in this series, the privatization of Banco Hipotecario was just one of many “irregular” privatizations during the presidency of Carlos Menem. That article will also reveal how Menem’s policies, as well as those of his economy ministers, directly resulted in the economic crisis Argentina faced in the early 2000s, in which the global elite — including controversial figures connected to Eduardo Elsztain, Henry Kissinger, the Rockefellers, and others — sought to use this engineered crisis to pressure Argentina’s government to “swap” their debt for the entirety of Patagonia.

That effort was ultimately unsuccessful. However, a similar collapse is now being engineered under the current presidency of Mauricio Macri — a close ally of Elsztain and Mindlin — with Patagonia again in the crosshairs.

As was noted in Part I of this series, the global elite, and particularly powerful elements of the global Zionist lobby, have long sought to create an independent state out of Patagonia for several reasons, with the goal of dominating its rich natural resources, freshwater and oil among them.

A dizzying flow-chart of tentacles

Elsztain’s acquisition of Banco Hipotecario was just one of the many moves made by him, in partnership with Soros and Mindlin, that have resulted in his multi-billion dollar net worth and the “largest business empire in Argentina.” Yet, as has been shown, none of that would have been possible without Elsztain’s connections to the elite and to Argentina’s government.

Today IRSA, under Elsztain’s reign, has become a true corporate behemoth and the country’s largest real estate company. Its portfolio encompasses nearly all of Argentina’s top shopping centers — including Alto Palmero, Abasto and Patio Bullrich, among others — as well as real estate in high-demand areas throughout Buenos Aires and a slew of rented offices and homes, and luxury hotels and resorts throughout the country

However, IRSA is but a part of Elsztain’s empire, a key component of which is the agricultural commodities company, Cresud, originally founded in 1937. Elsztain began buying Cresud shares in 1992 and then purchased a majority stake in 1994, paying around $25 million for control of the company. After the purchase, Soros put nearly $62 million into the company, which then went public with Soros’ backing on the New York Stock Exchange. IRSA then became owned by Cresud, with Elsztain retaining control of both.

Eduardo Elsztain celebrates the 20th anniversary of IRSA’s listing on the NYSE. Twitter | NYSE

According to a Haaretz profile on Elsztain, “It is not known whether, or to what extent, he leveraged (i.e., borrowed funds at a lower rate of interest than he expected to make) − for the purpose of acquiring control in Cresud, in which he has a 38 percent stake.” Today, Cresud — run by Elsztain’s brother Alejandro Elsztain — is one of the country’s top producers of beef and grain and dominates Argentine agribusiness organizations.

After his acquisition of Cresud — with the help of Soros and Mindlin — Elsztain “became only more aggressive in his pursuit of both urban and rural properties” after the Mexican economic crisis in 1994 and 1995, which “paid off,” according to the New York Times. As was noted in Part I of this series, that economic crisis in Mexico — the effects of which spread throughout Latin America, including Argentina — was partly due to the currency speculation conducted by another Soros associate — British billionaire Joe Lewis, who had “broken the Bank of England” with Soros just a few years prior using similar tactics — spurring the crisis from which Elsztain benefited via Cresud and IRSA. Lewis is the co-owner of Argentina’s largest private electricity company, Pampa Energía, with the other co-owner being long-time Elsztain associate Marcelo Mindlin.

Cresud is believed to be one of the largest, if not the largest, landowners in Argentina, possessing an estimated 2.5 million acres, in addition to even more farmland that it leases. It has been the driving force behind the destruction of family farms in Argentina; the mass planting of GMO soybeans; and the introduction of corn-fed beef feedlots, undermining Argentina’s long-standing reputation of providing high quality, grass-fed beef. Tellingly, the New York Times praised Cresud, under Elsztain’s management, for “smashing the nation’s quaint tradition of inefficient, underfinanced family farms and ranches.” Many of Cresud’s land holdings can be found in Argentina’s Patagonia.

Aside from Cresud’s and IRSA’s sizeable land holdings and business interests in Patagonia, Elsztain owns an estimated 100,000 hectares (247,000 acres) near San Carlos de Bariloche while Mindlin owns around 40,000 hectares (98,800 acres) just a few miles away from the similarly large property of Joe Lewis, whose “parallel state” in this area of Patagonia was the subject of Part I of this series.

Cresud’s control over land and agribusiness extends far beyond Argentina and into other South American nations such as Brazil, Paraguay and Bolivia through BrasilAgro, in which Cresud bought a controlling stake. Cresud also holds a major stake in the Elsztain-controlled bank, Banco Hipotecario, as well as another massive Argentine real estate company, APSA.

The spectacular growth of Elsztain’s business empire led the New York Times to write that his “fortunes are increasingly intertwined with the fortunes of [the] nation.” At the time, Soros held “about one-quarter of the shares of both companies [IRSA and Cresud],” according to the Times, though Elsztain eventually severed his business ties with Soros in 2000 and took complete control of the now-massive business empire.

Yet, this empire of Elsztain’s had been built with much more than help from Soros. Indeed, other key shareholders of IRSA who helped finance the acquisition of Cresud, BrasilAgro and other key holdings of Elsztain’s were three North American billionaires all known for their Zionist activism: Sam Zell, American real estate magnate; Michael Steinhardt, legendary hedge fund manager and chairman of Genie Energy’s Strategic Advisory Board; and Edgar Bronfman, whose fortune was made by the Seagram distilleries and Universal Studios, among others. Bronfman — former president of the World Jewish Congress, who was known for his closeness to the Clintons — had known Elsztain long before, as the two had previously met in Israel.

In addition to the help provided by powerful billionaires, the growth of Elsztain’s empire was notably aided by the government of Argentina on my occasions, not only during Menem’s presidency but also under the presidencies of Nestor Kirchner, his wife and successor Cristina Fernández de Kirchner, and — more recently — Mauricio Marci.

One clear example of this government-furnished aid is the fact that Argentina’s Social Security Administration (ANSES), which funds the majority of Argentina’s recently gutted social programs, is heavily invested in and has been used to buy shares of a raft of Elsztain and Mindlin-owned companies, including IRSA, Cresud, Alto Palmero SA, Pampa Energia, Edenor and Petrobras Argentina. In at least two cases, ANSES has been used by both Elsztain and Mindlin to fraudulently acquire companies and expand their business empires.

Elsztain and Israel

In 2012, Elsztain made a gamble to begin building a new business empire, not in Argentina but in Israel. His leap into Israel’s market took many by surprise, not for his decision to invest in the country, but where and with whom he had decided to invest. That September, news broke that Elsztain had offered embattled Israeli businessman Nochi Dankner $25 million to keep the latter’s sprawling business empire — IDB, Israel’s largest holding company — afloat. Not only that, but he promised to infuse an additional $75 million in the near future, to the shock of Israel’s financial sector and even IDB shareholders, who had increasingly lost faith in Dankner.

Elsztain’s reasons for investing so heavily and seemingly out of nowhere to prop up a controversial Israeli tycoon and prop up IDB led to considerable speculation in Israeli media. Notably, Haaretz asserted that it was likely linked to Elsztain’s long-standing “Zionist activism” as well as a “religious-spiritual element” stemming from his closeness to the New York-based Chabad movement. Indeed, Elsztain had been introduced to Dankner by Chabad Rabbi Yoshiyahu Pinto, whose father-in-law, Shlomo Ben Hamo, is the chief rabbi of Argentina. Pinto has been an important figure in past investments of Elsztain and his role — as well as those of other Chabad rabbis in Elsztain’s business activities, including the unscrupulous — will be discussed in a subsequent article in this series.

Haaretz further noted that the $25 million gamble would likely cause controversy in Elsztain’s home country of Argentina given that the money originated from Elsztain’s IRSA, in which ANSES is heavily invested. Thus, the Israeli paper stated:

Elsztain is taking the money that Argentine … workers have invested in his companies for their future retirement for his own speculative investment, the object of which is to salvage Dankner’s control of the IDB group.”

Elsztain’s promise of investing $75 million more in Dankner’s Ganden Holdings, through which he owned IDB, had fallen flat by July 2013, a decision Elsztain had made just a matter of days after becoming IDB’s deputy chairman. Though Elsztain backtracked on his plans to help Dankner maintain his hold on the company, Elsztain had no plans to abandon his ultimate goal of influence over IDB’s business empire and joined forces with a relatively unknown Israeli businessman, Moti Ben-Moshe.

By the end of the year, and with help from the Israeli court system, Elsztain and Ben-Moshe had wrested control of the massive holding company from Dankner and become its new owners. Then, just two years later, Elsztain ousted Ben-Moshe and became the sole controlling shareholder of the megacompany. Elsztain’s total investment in IDB through IRSA and IRSA affiliates is now believed to surpass $420 million.

Eduardo Elsztain speaks at an IDB event in Tel Aviv, Israel, March 23, 2017. Photo | Shai Shachar

IDB is one of Israel’s largest companies and among its holdings are Israel’s largest chain of supermarkets, Shufersal (sometimes written as Super-sol); the cornerstone of the Israeli tech industry and parent company of Elbit weapon systems, Elron Electronics; Israel’s fourth largest airline, Israir; Israeli kosher dairy giant Mehadrin; and one of Israel’s largest internet providers, CellCom; among others.

Soon after Elsztain acquired control over IDB, prominent Elsztain allies took top positions at IDB subsidiaries. For instance, Matthew Bronfman — who is in business with the Rothschilds and is the son of Elsztain ally and associate Edgar Bronfman — became a top shareholder in Shufersal, while Saúl Zang — Elsztain’s longtime lawyer and an IRSA executive — became vice chairman of Elron Electronics. Elsztain’s sister Diana, who has long lived in Israel, was also placed on IDB’s board. Another person placed on the IDB board by Elsztain is Giora Inbar, who used to chair TAT technologies, an Israeli company with U.S. subsidiaries whose clients include Boeing, Lockheed Martin and the U.S. Army. In addition, Benjamin Gantz — presidential candidate in upcoming Israeli elections and former IDF chief of staff during the 2014 war with Gaza, was on the board of directors of Elron Electronics, whose chairman is Elsztain, until just this past week.

Aside from IDB, Elsztain has also — through a separate company, Dolphin Netherlands BV — increased his holdings in several other Israeli companies. These include Nova Measuring Instruments — which focuses on artificial intelligence, big data and is a key company in global circuit manufacturing — as well as Paz Oil, Israel’s largest oil and gas company. Another Israeli company in which Elsztain has sizable holdings is Magic Software, which now plays a key role in Argentine elections and will be treated in detail in a subsequent section of this article.

Though his massive Israel-based business empire is beginning to rival his Argentine empire in size and influence, Elsztain has shown in recent years that he desires to continue expanding his business interests in the Zionist state. Last January, news broke that Elsztain sought to acquire Bezeq, Israel’s largest telecommunications company, after its owner Eurocom, controlled by Israeli businessman Shaul Elovitch, was “pressured” to give up the company by some of Israel’s largest banks, including Israel Discount Bank. Notably, the controlling stake of Israeli Discount Bank is owned by Matthew Bronfman, who is also a main stakeholder in IDB company Shufersal and whose father was a close associate of Elsztain in IRSA and at the World Jewish Congress, where Matthew Bronfman has also held prominent roles.

Despite his friends in high places, Elsztain has encountered difficulty after difficulty in his efforts to acquire Bezeq as a result of Israel’s anti-centralization laws — laws that ironically had helped him take control of IDB from its previous owner. Elsztain has tried to sell off IDB’s CellCom subsidiary — Bezeq’s main rival — in order to acquire Bezeq, but without success. He has since turned his efforts to buying Eurocom’s subsidiaries piece by piece, starting with Spacecom, an Israeli satellite operator. It remains to be seen if Bezeq’s recent financial difficulties have given Elsztain cold feet or are part of a behind-the-scenes effort to weaken and then acquire the company. Given his history, both are equally plausible.

Elsztain’s ties to and influence in Israel will become increasingly important in subsequent installments of this series, as Israel’s government, as well as prominent elements of the Zionist lobby to which Elsztain is connected, have been and are involved in past and current efforts to force Argentina’s governments to relinquish Patagonia.

Elsztain representing Rockefeller, Rothschild interests in Argentina

As Argentine newspaper La Nación noted in 2005:

[Elsztain is] the Argentine businessman with the greatest [international] contacts in the business world … and, like no other Argentine, has a direct channel to many of the world’s wealthiest men, who in many cases become his [Elsztain’s] partner in local projects.”

Indeed, Elsztain and his associates are often the avenue through which international oligarchs insert themselves into Argentina’s economy and politics, first for Soros and now for much more powerful figures.

The Council of the Americas (COA) was originally founded in 1963 by David Rockefeller as the Business Group for Latin America, which two years later became known as the Council for Latin America and then the Center for Inter-American Relations before undergoing a final name change. From its founding to its current state, the COA has been the voice of the multinational corporations (and the oligarchs behind them) that represent the vast majority of U.S.-based private investment in Latin America. The organization is often described as the Latin American equivalent of the Council on Foreign Relations (CFR), which was chaired by David Rockefeller for several decades and has long been heavily funded by the Rockefeller Foundation. David Rockefeller founded the COA while serving as CFR chairman.

Rockefeller was the COA chairman from 1981 to 1992 and was honorary chairman until his death in 2017. The vast majority of the directors on COA’s board are executives of Latin American operations of major European and U.S. multinational corporations such as Shell Oil, JP Morgan, PepsiCo, Chevron, Boeing, Citigroup and Microsoft. One of the group’s chairmen after Rockefeller was John Negroponte, who was involved in the Reagan era cover-up of U.S. support for Latin American death squads and was deeply involved in the creation of the North American Free Trade Agreement (NAFTA), which was the “brainchild” of COA. Negroponte also served as U.S. ambassador to Iraq and later deputy secretary of state under George W. Bush and was the first Director of National Intelligence (DNI). Negroponte is currently COA chairman emeritus and on its board of directors.

The current COA chairman is Andrés Gulski, a former IMF official and Santander bank executive who is currently CEO and President of AES power company, which — alongside Mindlin and Lewis’ Pampa Energia — is one of the top electricity producers in Argentina. Gulski also servedin Venezuela’s ministry of finance in the U.S.-backed, pre-Chávez government and more recently was on Barack Obama’s Export Council. COA’s current president and CEO is Susan Segal, a former JP Morgan executive who “was actively involved in the Latin American debt crisis of the 1980s and early 1990s, sitting on many Advisory Committees as well as serving as chairperson for the Chilean and Philippine Advisory Committees” while the former country was ruled by a brutal, U.S.-backed military dictatorship. She also received an award from Colombia’s then-President Alvaro Uribe, who once led Colombia’s right-wing narco-death squads.

While COA has long been formed and funded by Western multinational corporations, among the handful of Latin American-based companies that are both “elite” members and sponsors of the organization are IRSA and Pampa Energia. Other prominent COA sponsors include Citigroup, JP Morgan, and Soros’ Open Society Foundations. Elsztain and Mindlin are also both members of COA and are regular speakers at the annual Argentina Investment Conference that COA jointly hosts with Blackrock, the world’s largest investment management corporation. Mindlin and Elsztain also serve on COA’s International Advisory Council.

In addition to COA, Elsztain is a regular attendee of the World Economic Forum (WEF or “Davos”), as is Marcelo Mindlin. Elsztain is also a member of the Group of 50 (G50), which describes itself as “a select group of business leaders who head some of the most significant and forward-looking enterprises in Latin America.”

Eduardo Elsztain, left, with Argentine President Mauricio Macri on the sidelines of the 2016 Davos summit. Photo | Twitter

Membership is by invitation only. The G50 was founded in 1993 by Moses Naím, former director of Venezuela’s Central Bank and Venezuela’s minister of trade and industry in the 1990s, as well as former executive director of the World Bank. Naím, who still chairs G50, is also on the board of directors of Soros’ Open Society Foundations. G50 was originally founded with funding from the Carnegie Endowment for International Peace, which itself is funded by the Rockefeller Brothers Fund, the Open Society Foundations, and the U.S. and U.K. governments, among others. Naím is also on the board of directors of AES, whose president and CEO is also current COA Chairman Andrés Gulski.

While Elsztain and Mindlin are both well-connected to both George Soros and the Rockefeller-founded Council of Americas, Elsztain, for his part, shares ties with other well-known families of oligarchs: the Rothschilds and the Bronfmans. Elsztain’s close ties with the Bronfmans and the Rothschilds have largely manifested through his prominent positions at the global Zionist lobby organization, the World Jewish Congress (WJC), whose long-time president from 1981 to 2007 was Edgar Bronfman, the Seagram billionaire who was also a close friend of Elsztain and himself a key shareholder in Elsztain’s IRSA. Elsztain served previously as treasurer and chairman and is currently a vice president of the WJC and chair of the WJC business council. The WJC is currently chaired by David de Rothschild.

In addition to his connections to the Bronfmans through IRSA and WJC, Elsztain also serves on the board of Endeavor Argentina — the Argentine branch of Endeavor Global, whose chairmanis Edgar Bronfman Jr.

The role of the Rothschilds, Bronfmans and WJC in the events currently unfolding in Argentina — as well as the roles of other pertinent elements of the global Zionist lobby — will be explored in detail in a subsequent installment of this series. However, it is worth pointing out that the fortunes of the Rothschilds have become increasingly intertwined with those of the Rockefellers — particularly after RIT Capital Partners bought 37 percent of Rockefeller Financial Services in 2012 — as well as those of the Bronfmans, after the 2013 creation of Bronfman E.M. Rothschild E.L. LLC.

As these powerful oligarch dynasties move closer together, the links between these families and Elsztain should be cause for concern, in light of his role and the roles of his associates in bringing economic upheaval to Argentina and then directly profiting from that upheaval. Indeed, as investigative journalist and researcher Vanessa Beeley told MintPress, Elsztain’s — as well as Mindlin’s — connections to these groups and clans of oligarchs betrays their role as the Argentine faces of these powerful individuals who seek to claim and exploit Argentina’s resources:

Elsztain and Mindlin’s close connections to a merging network of some of the most powerful globalists in the world today suggest their role to be one of sniffing out the opportunities and laying the groundwork for hostile take-over of resources and infrastructure by these elite scavengers who prey upon target nations, protected from view by the likes of Elsztain and Mindlin, who are little more than mafia outreach agents.”

Getting their hooks into the voting machines

As the influence of Elsztain, Mindlin and their associates has expanded in Argentina as well as in Israel, this small, close-knit group of powerful billionaires has now set its sights on consolidating political power in Argentina for themselves and their even more powerful backers. Though the presidency of Macri has seen their influence grow in new and troubling ways, new evidence shows that Elsztain, with the backing of the Rothschild banking family, has set his sights on Argentina’s voting system.

For the past few years, Macri’s government has been heavily promoting the need for electronic voting systems in Argentina, which it argues are needed to modernize the country’s current paper-ballot system. However — as has been seen in other countries, including the U.S., where such systems have been implemented — the results of elections run on electronic voting systems can be easily manipulated and such manipulations are effectively impossible to detect.

Election forensics specialist Jonathan Simon, author of CODE RED: Computerized Elections and the War on American Democracy, had this to say about the vulnerability of such voting systems to interference:

They’re often rushed into use with great promises of speed, convenience, and accuracy, but these fully computerized voting systems — particularly those that provide no paper record of votes cast — have turned out to be problematic, to say the least, everywhere they have turned up, including the U.S. and several European countries. In fact the trend now is to ditch them in favor of return to paper-based systems. Ireland literally turned its voting computers into landfill; Norway, Germany, The Netherlands, and gradually the U.S. have all taken them out of service.

The reason is simple: as computers, this voting equipment is vulnerable not only to outsider hacking but to insider manipulation. It is trivial to program them to add, subtract, switch votes — and this is true whether or not they are hooked up to the internet. The worst part is that there is absolutely no way of verifying or validating the election results spit out by this equipment. All the hardware and software has been ruled ‘proprietary’ — corporate property, and off-limits to inspection by anyone, including governments.”

Simon also told MintPress that electronic voting machines, in contrast to making the voting system more “transparent” as Macri has claimed, instead can be used by politicians who wish to remain in power but unaccountable for their actions while in office:

If I wanted to take over a country — stay in power despite doing things that would surely get me voted out — I could stage a coup and roll tanks down the streets of the capital. Or I could install an electronic voting system — as Macri is trying to do in Argentina and as the right wing managed to do in 2002 in the U.S. — and achieve the same result without firing a shot, without provoking outrage or resistance, and without altering people’s perception that they lived in a democracy.

When you see politicians and powerful figures in a nation pushing such concealed and unverifiable systems for vote counting, the first thing you want to do is look past the marketing campaign — the talk of ‘transparency,’ which is nonsense, speed, convenience, etc. — and ask one very simple question: ‘Why?’”

Concerns about manipulation only increase when the manufacturers and programmers of those voting systems have troubling connections to oligarchs or foreign governments. Unfortunately for Argentina, the electronic voting machines being promoted by Macri have many such troubling connections.

Since his 2015 presidential campaign, Macri has pushed for the implementation of electronic voting nationwide, calling it necessary for creating “a more transparent voting system.” By 2017, Macri’s “comprehensive” voting reform legislation, which called for electronic voting nationwide, was passed by Argentina’s Congress — only to remain essentially frozen in its implementation, as holdovers from the previous administration in the government’s bureaucracy have worked to block the nationwide shift to digitized voting. Notably, a recent poll conducted in Argentina found that 60% of respondents would never consider voting for Macri in future elections.

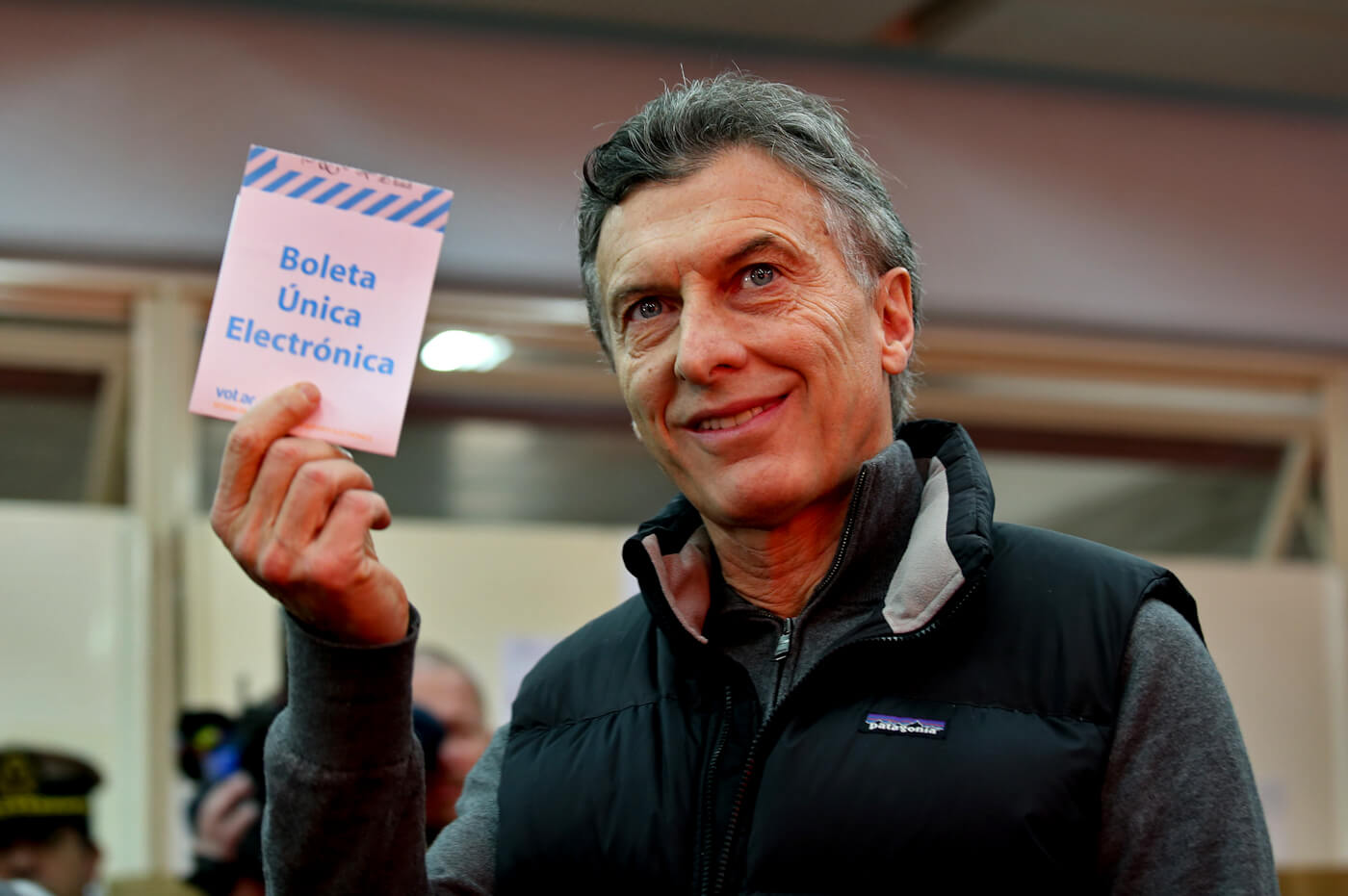

Mauricio Macri holds up a ballot which reads in Spanish “Unique Electronic Ballot” during mayoral elections in Buenos Aires, Argentina, July 5, 2015. Daniel Jayo | AP

Though the voting systems were not implemented nationwide, they are already being used in many areas of Argentina, including the city of Buenos Aires (population 2.89 million) and the provinces of Salta (1.2 million), Córdoba (3.3 million), Chaco (1 million), Tucumán (1.4 million), Santa Fe (3.2 million), and the Patagonian province of Neuquén (0.5 million). As a consequence, despite the lack of a nationwide system, more than 25 percent of Argentina’s population already votes using electronic machines, all of which are incidentally manufactured by a single company, Magic Software Argentina (MSA).

Concerns over MSA were voiced early-on in Argentine media, such as a report published in Letra P that noted that MSA had developed a close relationship with members of Macri’s inner circle and his political party in prior years, suggesting a conflict of interest. In addition, just last week, a man attempting to use an electronic voting machine in the Nequén province filmedhow the MSA-made voting machine printed out a result that was entirely different from the one he had chosen, prompting him to ask to vote again for his chosen candidate, a request that was initially denied. After the incident, several machines were found to be working improperly.

Though such reports are troubling, they barely scratch the surface of MSA and the more likely and troubling reasons why this company was given control over the democratic processes in many Argentine provinces and, if Macri gets his way, the entire country.

Magic Software Argentina was created in 1995 by Sergio Osvaldo Orlando Angelini and Alejandro Poznansky and, as noted by the Argentine outlet El Disenso, specializes in “importing, adapting and commercializing informatic systems in Argentina as well as representing and being the national face of foreign business like Magic Software Enterprises,” MSA’s parent company.

Magic Software Enterprises (MSE) was originally known as Mashov Software Export and is an Israeli software company headquartered in Or Yehuda. In 1991, the company changed its name and became the first Israeli software company to be listed on the Nasdaq. MSE has long had a close relationship with Israel’s military, the Israel Defense Forces (IDF), which was reaffirmed in 2010 when MSE was tasked with upgrading software systems for the IDF and Israel’s military police.

El Disenso noted in 2017 that MSE, as a result of having its headquarters in Israel as well as a branch in the United States, “is subject to the jurisdiction of Israel as well as North American [i.e., U.S.] courts…both countries impose strict security protocols that permit their national government[s] practically unlimited access to [company] information.”

While concerns about undue influence or meddling by either the U.S. and/or Israel are valid, an examination of the power behind MSA and its parent company MSE reveals something much more troubling, as well as just how influential Eduardo Elsztain has become.

MSE’s largest shareholders are IDB Development Corp Ltd and Clal Insurance Enterprises Holdings Ltd., and smaller shareholders include the Rothschild banking family through the firm Edmond de Rothschild Holdings. As previously mentioned, IDB Development Corp was acquired by Eduardo Elsztain in 2015. In addition, a majority stake in Clal Insurance Enterprises — MSE’s second largest shareholder — is owned by Dolphin Netherlands B.V., which incidentally is a subsidiary of IRSA, and Elsztain is chairman of its board. In other words, the most powerful and influential shareholder in both Magic Software Enterprises, and its Argentine subsidiary Magic Software Argentina, is none other than Eduardo Elsztain.

Devouring Argentina: a capitalist feast in many courses

In summary, through political connections, corruption and white-collar crime, this network of billionaires — the most visible of whom is Eduardo Elsztain — has essentially taken control of not only the bulk of Argentina’s resources — its electricity, its land, its agriculture, its water, its financial system — but also its voting system.

Yet, far from being purely an effort of powerful Argentine billionaires like Elsztain and Mindlin, control over Argentina’s economy, government, industry and land has long been a goal of powerful oligarchs dating back at least 70 years. Those very figures successfully engineered Argentina’s economic collapse in the early 2000s and then — through intermediaries close to Henry Kissinger, the IMF and the world’s largest banks — greatly pressured its government to relinquish Patagonia in exchange for “debt relief” from the economic chaos they had created.

The next installment of this investigative series will focus on Marcelo Mindlin and the interests of the Mindlin-Elsztain network in oil and gas in Argentina’s Patagonia, as well as in the contested Falkland Islands.

“The Owner”: The Rise of Eduardo Elsztain and the Coming End of Argentina’s Democracy

Whitney Webb

Whitney Webb is a MintPress News journalist based in Chile. She has contributed to several independent media outlets including Global Research, EcoWatch, the Ron Paul Institute and 21st Century Wire, among others. She has made several radio and television appearances and is the 2019 winner of the Serena Shim Award for Uncompromised Integrity in Journalism.

TheAltWorld

TheAltWorld

0 thoughts on ““The Owner”: The Rise of Eduardo Elsztain and the Coming End of Argentina’s Democracy”