The Chain Of Command: How Facebook’s Libra, Bank Regulators, and PayPal Built A New World Currency

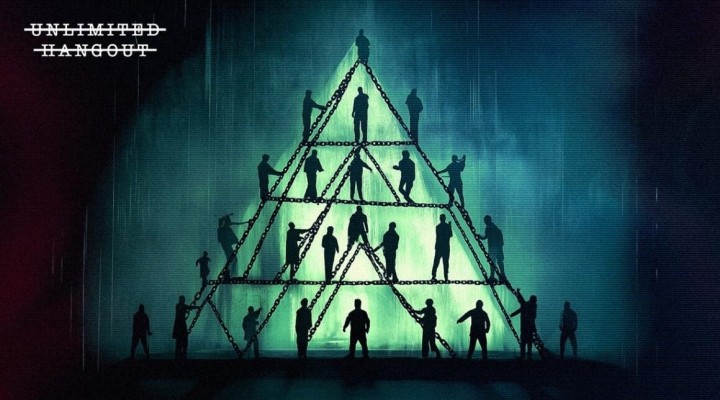

Two companies closely tied to Peter Thiel – PayPal and Facebook – have embarked on apparently unsuccessful efforts to create a “new world currency.” Yet, upon further examination, those efforts have actually been wildly successful and many recent events of significant in finance – including but not limited to the 2023 banking crisis – have arguably been orchestrated to facilitate the vision of Thiel and his early allies and the creation of a new paradigm for currency, one where privately issued money meets surveillance.

Key Takeaways

- A monetary network’s success is dependent on the size and volume of its active user base.

- The former lead of Facebook’s Libra project, David Marcus, is the former President of PayPal. PayPal’s founding mission, and subsequent T-shirt motto, was to create “A New World Currency.”

- Marcus built Facebook’s stablecoin project after concluding that Bitcoin lacked the qualities to be a successful medium of exchange.

- In order to appear decentralized, Libra formed the Libra Association, but included many very inter-connected businesses and people, as noted elsewhere in The Chain series.

- Government regulators, fearing Facebook’s immense active user base, quickly called the Libra team to testify before Congress, and eventually pressed the project to fold before launching.

- Libra had previously stated in their S-1 filings that regulatory pressure and uncertainty could lead the project to never launch. Other evidence suggests the entire goal of Libra was to perfect the public-private partnership for the future implementation of the U.S. government’s preferred digital currency project.

- Jared Kushner sent an email to Steve Mnuchin in May 2019 regarding a Sam Altman post on stablecoins titled “US Digital Currency.”

- Mnuchin’s Treasury then held a March 2020 meeting after inviting many figures mentioned in The Chain series, including Wences Casares and Peter Thiel.

- Libra announced partnerships with Fireblocks, Silvergate Bank, and Paxos in order to expedite their stablecoin project, but none materialized.

- After being shutdown by regulators, Libra sold off its assets to Silvergate Bank in January 2022.

- Silvergate facilitated Bitcoin-collateralized loans with MicroStrategy and Marathon Digital, and were partially owned by Block.One, BlackRock, State Street and Citadel Securites.

- Silvergate Bank, whose SEN product serviced a substantial amount of firms mentioned in The Chain series, was then liquidated by regulators in March 2023.

- Silicon Valley Bank (SVB), which failed two days after Silvergate, banked a significant amount of the companies and venture capital in the cryptocurrency industry.

- The day before the SVB collapse, Peter Thiel’s Founders Fund pulled out funds, and advised clients to do the same, triggering deposit flight.

- 10 customers alone had $13 billion in deposits at SVB, and $42 billion left the bank in 6 hours. In other words, SVB collapsed due to an acute liquidity crisis that was spawned by very few people.

- The Trump administration’s deregulation of the banking industry in 2018 loosened capital and reporting requirements, leading to many of the issues seen in the banking crisis in 2023.

- Circle’s USDC stablecoin, which had $3.3 billion of reserves at SVB, would “depeg” to 86 cents during the crisis.

- Six months after the banking crisis, and two weeks after the U.S. House Financial Services committee advanced their first stablecoin bill, Paxos and PayPal launched PYUSD.

- The Gillibrand-Lummis Stablecoin Bill was directly influenced by the Terra-LUNA collapse, which resembles more of a controlled demolition than an organic collapse. As a result, the bill bans algorithmic alternatives in pursuit of preserving the dual banking system. Both Senator Gillibrand and Senator Lummis have significant donor ties to many of the firms mentioned in The Chain series.

- Large lobbying groups, such as Coin Center and the Digital Chamber of Commerce, were formed to help guide legislation as it relates to stablecoins and digital assets. Both of these lobbying groups have advisory ties to stablecoin issuers and many firms and people mentioned thus far in The Chain series.

- Multiple parties mentioned in this piece, from the Libra team to lobbyists, have echoed the sentiment that USD stablecoins can help retain the U.S. dollar as the world’s reserve currency.

- Many of the companies formed after the dissolving of Libra carry on the work of building a new financial system based on stablecoins and public blockchains.

- According to national security state members, Bitcoin and stablecoins can provide a “boon for surveillance” in addition to helping grow the economy.

- The Bitcoin-Dollar system, as described in The Chain series, is the actualization of PayPal’s founding intention to create a “new world currency”, and it was carefully constructed to appear as an organic phenomenon when it is not.

The initial trio of pieces in The Chain series have focused on the three essential pillars for creating a new digital monetary system. The first, The Chain of Custody, examined the construction of novel custodial infrastructure to enable the secure holding of billions of dollars worth of digital assets after the proliferation of Bitcoin as a new financial class. The second, The Chain of Issuance, investigated the primordial roots of digital payments fortifying data brokers and information bankers within the global surveillance network. It also noted how stablecoin issuers are the modern day analogue to the influence that the major infrastructural titans of the Industrial Age had on the formation of The Federal Reserve in the first half of the 20th century. The third, The Chain of Consensus, focused on the currency speculators and intelligence-connected developers behind the monetary policy and consensus infrastructure of privately-issued money and the blockchain revolution during the infancy of the Deflationary Age brought about by Bitcoin and the subsequent, dollarized iterations of its underlying database technology.

In summary, a new financial system cannot be built without the ability to custody assets, issue new assets, and uphold the settlement and monetary policy of said assets via a governing consensus. Yet, even with the successful formation of this necessary trifecta, the construction of a monetary network is simply fruitless without the acquisition of the last remaining pillar: a network of active users. This concept is well understood by both the private sector companies that have been mentioned throughout this series, in addition to the public sector that currently acts as the enabling environment for the rules and regulations of nation-state monetary systems upheld by central banks across the world. None of these public issuers of money, however, have the global impact of the U.S. Federal Reserve and the U.S. Treasury system, which provides immense privileges that come downstream from their issuance of the notes and reserves backing the world reserve currency, the U.S. dollar. With 66 countries worldwide listing the dollar as an official currency, the vast number of users utilizing these instruments makes the dollar system the largest financial network in the world.

Even within this monopoly, there is a fractured set of settlement networks, such as PayPal, and private banks, such as J.P. Morgan, issuing said dollars in users’ checking accounts. This balkanization presents a unique opportunity for further consolidation and, with that consolidation, the ability to acquire even more users. For example, PayPal acquired millions of global users via their purchases of Venmo and Xoom, while J.P. Morgan assumed the deposits of the failed First Republic Bank after the onset of the regional banking crisis in 2023.

Money itself is but a technology that enables agreeable and predictable outcomes between two bartering parties. This axiom requires money that simultaneously acts as a unit of account, a store of value, and a medium of exchange. While all of these properties can be met by a multitude of currently circulating currencies – and even commodities – their usefulness for settlement across both time and space is determined nearly entirely by the number of users within their respective networks. The dollar system is the most liquid monetary network in the world, and has held this position for nearly a century. Historically, the world’s reserve currency has held its dominant status for roughly this same duration of time. With U.S. debt levels now growing at uncontrollable and exponential rates, the formation of proposed alternatives to the dollar’s monopoly are popping up across the globe. The world economy is a finite pie consisting of finite users, and with the dollar network appearing truly weak for the first time in decades, competitors are posturing for a piece. However, with the global broadband internet dissolving some of the control that nation states have over their own citizens’ monetary choices, the world is actually dollarizing faster than ever.

As the internet age enters its third decade, the stakes for creating the internet of money have never been higher. For now, the proliferation of dollarized blockchains seemingly aims to fortify the dollar’s hold over global finance, not dissolve it. Regardless of the dollar’s domination of denomination, the upstart issuers of these tokenized assets have hemorrhaged away enough users that it now threatens many of the privileges the legacy system once enjoyed, mainly the available profits found by selling their data and leveraging their deposits.

The understanding that social networks are communication platforms, and that money itself is just a ledger upholding the communicative expression between users, led the social media giant Facebook to experiment with adding financial instruments to their vastly popular Messenger app. While Bitcoin and alternatives had been around for nearly a decade before Facebook’s Libra was proposed, this was “the shot heard ’round the world” for central bankers and regulators to sit up straight and take a novel payments system proposed by the world’s largest social network seriously.

Yet, as Facebook soon found out, if you come at the king, you best not miss. Or at least this was the story that was told to the world: The U.S. regulatory system said “No” and that was that. However, this concluding piece to The Chain series, The Chain of Command, postulates that Libra was never intended to actually go to market as designed, but rather was meant to set the stage for clear regulation via legislation that would become the enabling environment for a decades-long attempt at creating a new world currency by the very same parties covered thus far in this series.

Libra, Diem and Facebook’s Stablecoin

Sitting on a Caribbean beach during the winter of 2017, David Marcus was struck with the idea of creating a global digital currency to run on Facebook’s Messenger. Marcus, who had sold his mobile payment provider Zong to PayPal for $240 million in 2011, and who had been introduced to Bitcoin in 2009, was certainly no spring chicken to the rapidly evolving FinTech and digital payments space. Within nine month of Zong’s acquisition by PayPal, Marcus was named PayPal’s president in April 2012. Then, in June 2014, Marcus was recruited by Facebook’s Mark Zuckerberg to run their Messenger app. By the time the idea that would become Libra began to germinate during his 2017 vacation in the Dominican Republic, the social network’s messenger app boasted over 1.3 billion active users.

Prior to his experience with PayPal and Facebook, Marcus had founded GTN Telecom, noted as being the “first to break Switzerland’s telecommunications monopoly” in 1996. GTN Telecom was backed by the UK’s 3i, a venture capital firm founded in 1945 by the Bank of England and “a syndicate of British banks,” and was later sold in 2000 to WorldCom’s World Access just two years before WorldCom would file for Chapter 11 bankruptcy after excessive accounting fraud. Marcus went on to found Echovox, a “mobile monetization company focused on monetizing web and traditional media audiences” via “transaction-enabled mobile services,” shortly after the October 2000 sale of GTN. Zong was later spun off from Echovox. Bertrand Perez and Kurt Hemecker, two executives at Zong, would become part of the founding team at Libra alongside Marcus.

“In late 2009 when I first stumbled upon Bitcoin and read the white paper, I tried to play with it, but it was so cumbersome even for a geek like me. I just couldn’t get it. So I kind of put it aside, brushed it aside, and then came back to it in 2012 when a good friend of mine who’s often referred to as a Patient Zero in Silicon Valley for Bitcoin, [Xapo’s] Wences Casares, basically started telling me more about it and telling me ‘you have to actually spend time and understand this thing.’ And so I did. And then I just couldn’t stop thinking about it. I just couldn’t stop thinking about this idea that you could actually be your own self-sovereign for digital value and you could move it around without any intermediary in between…

Then in 2013 at PayPal, that’s after Zong got acquired by PayPal and I was running it, I remember that Argentina asked us to actually stop the flow of money going out of the country from PayPal accounts located in Argentina. And I remember us having to comply because we were regulated entity, and seeing the price of Bitcoin rise the same day. And it was really clear that a lot of Argentines at the time were actually moving their funds into Bitcoin so that they would have control over their hard-earned money.”

David Marcus, The Block, June 27, 2023

According to reporting from Financial Times, Marcus, a close confidant of Zuckerberg, apparently “texted Zuckerberg to outline his ruminations” and after successfully convincing Facebook’s CEO, he was given a “blessing to explore the idea further.” Marcus quickly outlined his idea in an internal memo, highlighting that “Facebook’s more than two-billion-strong user base” empowered with crypto “could offer a convenient and cheap way to move money around the world,” in addition to providing “a treasure trove of data about what people spend their money on.”

For the social network, the “possible multi-billion-dollar commercial opportunities were clear,” including “user transaction data,” “more engagement,” “more e-commerce,” and “a slice of fees from transactions.” According to an unnamed regulatory official, this “was always their advantage.” Libra would “create tremendous opportunity and a lot of money for them. But if Facebook was going to be the reason it was very successful, they were also going to be the reason it would fail.”

During the months right after Libra’s announcement, Marcus updated his thoughts on Bitcoin, stating “For me, now, it’s clearer that Bitcoin serves a purpose of being digital gold, not a good medium of exchange.” It was this axiom that led Marcus to express that “this was the right time for us to start thinking about how we could address the very things that blockchain and cryptocurrency were meant to do” and that “we had real solutions to bring to the fore.” Marcus later explained his motivations for bringing publicly-issued money via tokenized dollars to the Libra experiment in an August 2023 conversation with Bankless:

“I don’t think that I’m in the camp of people who want to fully separate money from State. I feel like my own personal objective is to actually make the underlying rails really efficient, really open, really interoperable, and enable more people to have access to them. I think that the world where actually good governments cannot control their own monetary policy, etc., this world where it doesn’t exist, would be chaos.”

It is perhaps this affinity for State-controlled monetary policy that led Marcus to announce Libra to the world within the confines of The Old San Francisco Mint in June 2019. However, the project itself was started both in earnest and in secrecy by Facebook in early 2018, when Morgan Beller, a former partner of Andreessen Horowitz, joined Marcus in plotting to bring both payments and a novel currency construction to Facebook’s Messenger product. According to reporting from the Financial Times, the pair first worked “in a small, empty room” with “walls adorned with whiteboards” within “Facebook’s main campus in Menlo Park.” Shortly after, the duo “moved to a larger, more secluded building” positioned “on the outskirts of the company’s headquarters” that limited access to “only employees with particular passes” consisting of “the crypto experts, engineers and economists.” The project was codenamed Libra, and Beller was quoted as saying that the team was “paranoid about leaks” and operated “like a secret Swat operation.”

In addition to Beller, Marcus was quickly joined by Christian Catalini, a research scientist at MIT who had founded the MIT Cryptoeconomics Lab. While there, Catalini designed the MIT Digital Currency Research Study, which “gave access to Bitcoin to all MIT undergraduate students.” In 2013, Catalini became a member of the Technology Advisory Committee of The Commodity Futures Trading Commission (CFTC) alongside his advisory board appointments to Coinbase, Algorand, Chainlink and Hivemind Capital. Catalini became essential to the development of Libra, and is noted as being a co-creator of Libra and Chief Economist of the Diem Association after Libra rebranded to Diem, in addition to his title of Head Economist at Meta FinTech.

Catalini, alongside Jai Massari – a partner in the Financial Institutions Group of Davis Polk & Wardwell LLP and an outside counsel to Diem – wrote a piece titled “Stablecoins and the Future of Money” which proposes that “through a sensible regulatory approach, true stablecoins can fulfill their promise without introducing new risks.” Their theory on the next evolution of money, which was demonstrated throughout the multitude of iterations of Libra, is excerpted below:

“Modern money is a combination of public and private money. Public money includes central banks-issued cash and digital claims against central banks. Private money includes deposit claims against commercial banks. While the public sector protects the stability of money, up to 95% of money in developed economies is private. Stablecoins are a form of private money. This is not a new concept — the idea of separating monetary and credit functions traces back 80 years. By lowering the cost of digital verification, blockchain technology can expand the role of both the public and private sector in the provision of money. While the public sector could attempt to connect with consumers and businesses directly, the private sector is likely to be more efficient in meeting the public’s needs and increasing choice.

Succeeding in this transformation will require the right balance between the public and private sectors. Countries that overemphasize the public approach will likely end up falling short in speed to market, competition, and innovation…The public sector may also struggle with serving citizens and businesses effectively. Given the incredibly high bar in terms of resilience and security, it will likely take years for a CBDC to be developed and adopted…This is where CBDCs and stablecoins are strong complements, not substitutes. The public sector could focus on issuing digital coins and delivering on sound money, while the private sector could build rails and applications. Competition with legacy networks would further ensure a higher degree of resilience and innovation…

The question for central banks and regulators then becomes which combination of the three approaches [“true” stablecoins, deposit coins, and CBDCs] can also improve competition, lower cost, and increase access to the financial system…A much stronger combination would be the public sector focusing on regulation of stablecoins first, and then on CBDC issuance on multiple rails later to complement potential shortcomings…Public sector guidance and standard setting can be incredibly useful in promoting the right solutions in these areas…In the case of money, the public and private sectors can play to their relative strengths, solidify their public-private partnership, and improve societal outcomes in the process.”

Catalini, Massari, and Marcus would all go on to form LightSpark – an institutional payments company focused on Bitcoin and the Lightning Network – after the dissolution of the Libra project. The pivot back towards Bitcoin and specifically the Lightning Network is perhaps best exemplified by the regulatory realities within the United States. As Marcus stated to The Block: “I just want to state that I feel like it’s a shame that we’re in this current state of uncertainty from a regulatory standpoint as a country… I think you know the reason Bitcoin is so special is because, first of all, it is the only asset out there that has been clearly defined as not a security by the SEC in the U.S.” In fact, the Libra team actually met with Lightning Labs at the onset of the project while still in the process of determining the best course of action to build Facebook’s digital currency. According to Marcus during a discussion with Bankless, “In early 2018,” the Libra team “went to see Lightning Labs team in SF and we looked at Lightning as one of the ways to actually do this.” In this interview, he further articulated his position on Lightning, bringing stablecoins to Bitcoin, and even algorithmic stablecoins:

“I’m actually all for stablecoins on top of Lightning when that becomes a thing and there are a number of work streams that are out there to make that happen. I think my problem is actually if you’re dependent on one stablecoin, or one asset, to be the native core settlement asset of a payment network, then you have a problem because the algorithmic stablecoins don’t work in my opinion. I really believe that it’ll never work and so stablecoins need to have a reserve and someone controls that reserve and if someone controls that reserve, then it’s the single point of failure of your entire payment network if you’re solely dependent on it.”

Despite the team’s interest in Bitcoin, Marcus stated that “unfortunately the tech just wasn’t ready for prime time and certainly not for scaling to the type of scale that Meta had with its Messaging apps.” This realization led Marcus and his team to “actually go build new tech and that’s what we did.”

After the Libra project was announced to the world in 2019, there were a few organizational strategies employed in order to mitigate the appearance of centralization, including the establishment of the Libra Council, the Libra Association, and the board of directors. All three of these groupings were formed during the inaugural meeting held in October 2019 in Geneva, Switzerland. The first batch of organizations that signed on as members included: “Anchorage, Andreessen Horowitz, Bison Trails Co., Breakthrough Initiatives, L.P., Novi Financial [initially known as Calibra, the company responsible for building the wallet software for Libra], Coinbase, Inc., Creative Destruction Lab, Farfetch UK Limited, Iliad, Kiva Microfunds, Lyft, Inc., Mercy Corps, PayU, Ribbit Capital, Spotify AB, Thrive Capital, Uber Technologies, Inc., Union Square Ventures, Vodafone, Women’s World Banking, [and] Xapo Holdings Limited.”

Many of the companies listed here have appeared within The Chain series, including the only OCC-chartered crypto bank Anchorage Digital, Marc Andreessen’s Andreeseen Horowitz, Coinbase, the PayPal- and Omidyar -affiliated Kiva, Meyer Malka’s Ribbit Capital, Fred Wilson’s Union Square Ventures, and Wences Casares’ Xapo. Others that have not been previously discussed in this series also boast ties to this same network. For instance, Thrive Capital, the venture capital firm of Joshua Kushner (Jared Kushner’s brother), raised $40 million in 2011 from investors including Peter Thiel, the Wellcome Trust, and Princeton University, while it later took an estimated $120 million from Goldman Sachs in 2021 via their Petershill Partners affiliate. The firm is advised by Twitter founder Jack Dorsey and holds a “good percentage” of the online payment juggernaut, Stripe, which in 2023 raised nearly $6.5 billion from Andreessen Horowitz, Thiel’s Founders Fund and Goldman Sachs. In October 2024, Stripe would spend $1.1 billion to acquire stablecoin issuer Bridge, leading Stripe CEO Patrick Collison to refer to stablecoins as “room-temperature superconductors for financial services.”

Another example is Breakthrough Initiatives, which was formed by DST Global founder and Xapo investor Yuri Milner. Milner is perhaps best known for creating The Breakthrough Prize with Mark Zuckerberg and Anne Wojcicki, the ex-wife of Google’s Sergey Brin and current CEO of 23andMe. The Creative Destruction Lab is a non-profit that has partnered with XPRIZE, a foundation started by Singularity University’s Peter Diamandis with a board featuring Google’s Larry Page, Elon Musk, film director James Cameron, and Google’s Ray Kurzweil, who sponsored the Singularity Summit in 2006 alongside Thiel and the Machine Intelligence Research Institute, the latter was advised by Thiel and blockchain pioneer Jed McCaleb. McCaleb is best known for founding the first significant Bitcoin exchange, Mt.Gox, in addition to Ripple Labs and Stellar, the latter of which raised funds from “Stripe and PayPal executives” and features the PayPal Mafia’s Keith Rabois, Thiel-protégé Sam Altman, Stripe CEO Patrick Collison, and the Idealab– and Thiel–affiliated Naval Ravikant as advisors.

In addition to the Libra Association, a technical steering committee was formed in December 2019. Five members were elected including Anchorage Digital co-founder Diogo Mónica, Calibra core product lead George Cabrera III, Bison Trails founder Joe Lallouz, Union Square Ventures partner Nick Grossman, and Mercy Corps emerging technology director Ric Shreves. The Libra Council also appointed a board of directors, which included Matthew Davie of Kiva Microfunds; Patrick Ellis of PayU; Katie Haun of Andreessen Horowitz; David Marcus of Novi Financial; and Wences Casares of Xapo Holdings Limited. The Libra board, once established, voted on and appointed the initial Libra Association staff, including Bertrand Perez as Chief Operating Officer and Interim Managing Director; Dante Disparte as Head of Policy and Communications; and Kurt Hemecker as Head of Business Development. In addition to other Libra team members not mentioned in the early press releases, Laura Morgan Walsh, a 13-year veteran of PayPal, was named Head of Operations.

Katie Haun, in addition to her role at Andreessen Horowitz, is the Founder and CEO of Haun Ventures, alongside Libra steering committee member Diogo Mónica. Haun, a lifetime member of the Council of Foreign Relations (CFR), and a Coinbase board member from 2017 until 2024, began her career with a decade long stint as a federal prosecutor serving the SEC, the FBI and the Treasury, responsible for creating the U.S. government’s first cryptocurrency task force that helped lead investigations into the Mt.Gox hack and the Silk Road prosecution. Haun went to Stanford Law School, and studied with Sam Bankman-Fried’s parents, meeting the now infamous and disgraced head of FTX when he was only a child. Casares, featured in The Chain of Custody, is a long-time friend of Marcus, and joined the PayPal board in 2016, in addition to being on the board of Kiva and the executive chairman and founder of the cryptocurrency lobbying group, Coin Center.

In addition to the initial 21 companies that signed on to the Libra Association, payment stalwarts Visa, PayPal, Mastercard, Stripe and Mercado Pago all expressed interest in the project, before promptly dropping out, alongside PayPal-acquirer eBay, after pressure from U.S. regulators. Senator Brian Schatz (D-HI) and Senator Sherrod Brown (D-OH) sent letters to Visa CEO Alfred Kelly, Jr., Stripe CEO Patrick Collinson, and Mastercard CEO Ajaypal Banga “over the firms’ participation in the developing network.” “It is chilling to think what could happen if Facebook combines encrypted messaging with embedded anonymous global payments via Libra.” Schatz and Brown also suggested that participating firms “such as Visa, Stripe, and Mastercard” may see “heightened regulatory scrutiny overall” as a result of Libra Association membership when they wrote: “If you take this on, you can expect a high level of scrutiny from regulators not only on Libra-related payment activities, but on all payment activities.”

This sentiment was first initiated by Maxine Waters, the Californian congresswoman who sat as the Chair of the House Financial Services Committee during the Libra hearings, in a letter dated July 2, 2019:

“We write to request that Facebook and its partners immediately agree to a moratorium on any movement forward on Libra—its proposed cryptocurrency and Calibra—its proposed digital wallet. It appears that these products may lend themselves to an entirely new global financial system that is based out of Switzerland and intended to rival U.S. monetary policy and the dollar. This raises serious privacy, trading, national security, and monetary policy concerns for not only Facebook’s over 2 billion users, but also for investors, consumers, and the broader global economy.

On June 18, 2019, Facebook announced its plans to develop a new cryptocurrency, called Libra, and a digital wallet to store this cryptocurrency, known as Calibra…While Facebook has published a “white paper” on these projects, the scant information provided about the intent, roles, potential use, and security of the Libra and Calibra exposes the massive scale of the risks and the lack of clear regulatory protections. If products and services like these are left improperly regulated and without sufficient oversight, they could pose systemic risks that endanger U.S. and global financial stability. These vulnerabilities could be exploited and obscured by bad actors, as other cryptocurrencies, exchanges, and wallets have been in the past. Indeed, regulators around the globe have already expressed similar concerns, illustrating the need for robust oversight…

These risks are even more glaring in light of Facebook’s troubled past, where it did not always keep its users’ information safe. For example, Cambridge Analytica, a political consulting firm hired by the 2016 Trump campaign, had access to more than 50 million Facebook users’ private data which it used to influence voting behavior. As a result, Facebook expects to pay fines up to $5 billion to the Federal Trade Commission (FTC), and remains under a consent order from FTC for deceiving consumers and failing to keep consumer data private…

Because Facebook is already in the hands of a over quarter of the world’s population, it is imperative that Facebook and its partners immediately cease implementation plans until regulators and Congress have an opportunity to examine these issues and take action. During this moratorium, we intend to hold public hearings on the risks and benefits of cryptocurrency-based activities and explore legislative solutions. Failure to cease implementation before we can do so, risks a new Swiss-based financial system that is too big to fail.”

Representative Waters furthered this apprehension in a letter penned the next month, August 2019, in which she stated that her “concerns remain with allowing a large tech company to create a privately controlled, alternative global currency.” David Gerard, the author of Libra Shrugged: How Facebook Tried to Take Over the Money, made note that “The attacks were absolutely bipartisan because both sides agree: you don’t mess with the money…This is what happens when the dreams of bitcoin bros meet reality.” In agreement with Gerard’s comment, both Waters and the Trump-nominated Federal Reserve Chair Jerome Powell expressed issues regarding Libra during Powell’s testimony before the House Committee on Financial Services in July 2019. Waters reiterated her concerns at the onset of the hearing, articulating that she “believe[s] that what Facebook is planning raises serious privacy, trading, national security and monetary policy concerns for consumers, investors, the US economy, and the global economy,” and further noted that “Facebook’s foray into this field should signal to all of us that our current system of regulation lacks adequate coordination safeguards and attention to crypto.” Waters even called upon Powell to “be a leader on this issue,” and that the Fed chair “should not take a wait-and-see approach when it comes to examining a financial system involving 2.4 billion people.” Powell seemed to be in agreement that Facebook’s large active user base presented problems for regulators not yet seen in other cryptocurrency experiments:

“Due to the to the possibility of quite broad adoption, Facebook has a couple billion plus users, so you have, I think, for the first time, the possibility of a very broad adoption. And if there were problems there associated with money laundering, terrorist financing – any of the things that we’re all focused on, including the company, they would immediately arise to systemically important levels just because of the mere size of the Facebook network.”

Jerome Powell, July 10, 2019, U.S. House of Representatives

Then-Treasury Secretary Steve Mnuchin, who initially recommended Powell to President Trump for the Fed Chair position, took a slightly more optimistic approach in commenting on Facebook’s currency plans, stating that “I’m fine if Facebook wants to create a digital currency, but they need to be fully compliant,” and “in no way can this be used for terrorist financing.” While on the topic of issuing digital currency, Mnuchin revealed that “Powell and I have discussed this – we both agree that in the near future, in the next five years, we see no need for the Fed to issue a digital currency.” In addition to discussions within the Trump administration, Powell had also confirmed that his team had “met with Facebook representatives in the months ahead of the Libra announcement,” in “part of the tech company’s global tour of meetings with financial authorities.”

According to reporting from Wired, many regulators “left those meetings unsatisfied,” and that “regulators in the UK, Japan, and Singapore have called for greater scrutiny of Libra in recent weeks.” At the time, the Bank of England expressed that “Facebook has made rounds with regulators around the world to discuss its plans [Libra], including us. There are benefits…but also risks we’re watching, and echo the statement [Bank of England] Governor Carney issued.” Then-BoE governor Mark Carney said he was “open-minded about Facebook’s Libra token,” but “warned mass adoption would force it” to “be subject to the highest standards of regulation.” Mu Changchun, the deputy director of the People’s Bank of China’s payment department told Bloomberg it “won’t be sustainable without the support and supervision of central banks.” France even set up a task force within the Group of Seven (G7) nations to discuss Libra, leading France’s finance minister Bruno Le Maire to state “It is out of question” that Libra be allowed to “become a sovereign currency,” and that “it can’t and it must not happen.”

In addition to these meetings by global financial regulators, President Trump himself held a dinner with Zuckerberg and Facebook board member Peter Thiel at the White House in October 2019 after the Facebook CEO testified to Congress regarding Libra. It was the second time Zuckerberg had met with Trump that Fall after a September 2019 meeting in the Oval Office. A few months before, Trump’s son-in-law and special adviser, Jared Kushner, had emailed Mnuchin in May 2019 regarding a blog post by Peter Thiel protégé Sam Altman titled “US Digital Currency,” in which Altman expressed a novel method for the country to attempt to adopt rather than attempt to stop cryptocurrency:

“I am pretty sure cryptocurrency is here to stay in some form (at least as a store of value, which is the only use case we have seen work at scale so far). There was possibly a time when governments could have totally stopped it, but it feels like that’s in the rearview mirror.

However, I think it’s very possible that the dominant cryptocurrency hasn’t been created yet (Google was years late to the search engine party, and Facebook came long after most people assumed the social network wars were won). And from the perspective of a nation, there are real problems with current systems, especially around pseudo-anonymity, ability to function as an actual currency, and taxability.

Although I don’t think the US government can stop cryptocurrency, I do think it could create the winner–let’s call it “USDC” for US Digital Currency–and fix some challenges that governments currently face with cryptocurrency. I think the first superpower government to do something like this will have an enviable position in the future of the world, and some power over a worldwide currency. The US government could decide to treat USDC as a second legal currency, which would be hugely powerful.”

Kushner asked Mnuchin his thoughts on a U.S. Digital Currency, and even suggested putting together a focus group to discuss: “Steven – Would you be open to me bringing a small group of people to have a brainstorm about this topic?” Kushner wrote. “My sense is it could make sense… and also be something that could ultimately change the way we pay out entitlements as well saving us a ton in waste fraud and also in transaction costs.” This email was revealed in “The Mnuchin Files,” which were obtained by CoinDesk via a FOIA request at the start of 2022. Within these files was the revelation that the Treasury had held a handful of meetings with regulators and private-sector payment companies involved in blockchain. One of these meetings was a March 2, 2020 “crypto summit” that featured prominent figures from The Chain series, including; Meyer Malka of Ribbit Capital, Joey Garcia of Isolas (in addition to positions at Xapo and RSK), Jack Dorsey of Twitter, Jerry Brito of Coin Center, Brian Armstrong of Coinbase, Peter Briger of Fortress (in addition to stints at Goldman Sachs, the Council of Foreign Relations, and PayPal’s Digital Advisory Board), Michael Gronager of the CIA-funded Chainalysis, Wences Casares of Xapo, and Jeffrey Yass of Susquehanna. Thiel was invited to this meeting, but was unable to attend. In addition to these private sector stalwarts, “high-ranking government officials from the Treasury, FinCEN, the FBI and other agencies” were also present.

Coinbase’s Chief Financial Officer, Alesia Haas “has a personal friendship with Secretary Mnuchin,” according to an email sent to the Treasury department. According to commentary from CoinDesk, Haas was previously CFO at OneWest, the bank Mnuchin ran during the 2008 financial crisis, that also employed former Coinbase executive Brian Brooks, who was made Acting Comptroller of the Currency in May 2020 via Mnuchin’s designation. While only at the OCC for a year, Brooks introduced “regulatory initiatives that provided banks with the green light to offer cryptocurrency custody services and stablecoin payment systems,” before leaving to re-join the private sector, including a three-month stint as CEO of Binance.US. The same month of Brooks appointment, May 2020, Haas was present during a Treasury conference call with Coinbase CEO Armstrong. Brooks allowed Anchorage Digital, a Libra Association member advised by PayPal co-founder Max Levchin, to secure a national trust charter and become the nation’s first and only approved “digital asset bank,” just days before he stepped down from his role in January 2021.

Republican Senator Mike Rounds of South Dakota penned a favorable letter to Anchorage in October 2019, becoming the first elected official to “endorse” the Libra project, stating: “Technologies like Libra … have the potential to help unbanked and underbanked consumers right here at home… It would be unfortunate to shun a new solution that could connect more of the most vulnerable Americans to our financial services system… Given the length of time it will take for the Fed to finish FedNow, the Libra Association should not wait to see if recent conversations about a Fed-run digital currency come to fruition.” While Senator Rounds endorsed Facebook’s project, few members of the regulatory arms of the U.S. seemed to share these sentiments.

Facebook, facing social and political prosecution for their involvement in what is now known as the Cambridge Analytica data scandal, was dealing with a crisis of confidence from their users and regulators as the Libra project began. Notably, Cambridge Analytica involved not just one but two companies closely connected to Peter Thiel: Facebook and CIA contractor Palantir. In addition, two prominent figures in the Cambridge Analytica data scandal, which was key to the successful campaign of President Trump, were Steve Bannon and Brittany Nicole Kaiser, with Bannon being referred to as Tether-cofounder Brock Pierce’s “right hand man,” and Kaiser having been the campaign manager for Pierce’s failed 2020 presidential campaign. Pierce would also “pop up” in campaign finance reports as a “Trump campaign megadonor,” who once spent $100,000 for “dinner and access” to Trump and Mnuchin. Zuckerberg himself acknowledged the impact of the scandal on Facebook’s crypto prospects when he told lawmakers in 2019, “I understand we’re not the ideal messenger right now . . . I’m sure people wish it was anyone but Facebook putting this idea forward.”

This self-acknowledged affliction on Facebook’s image led the company to make choice selections while building out the second iteration of Libra’s team. In May 2020, Facebook appointed Stuart Levey – the former Under Secretary for Terrorism and Financial Intelligence at the Treasury Department under President Bush and President Obama, senior staff at the Department of Justice, Chief Legal Officer of HSBC, and a senior fellow at the Council of Foreign Relations – as the CEO of Libra. After the shuttering of Libra/Diem, Levey joined CIA-front Oracle as an Executive Vice President and Chief Legal Officer. Libra would similarly hire Steve Bunnell – former Chief of the Criminal Division at the U.S. Attorney’s office, general counsel for the Department of Homeland Security, and Fellow of the Trilateral Commission – to become its Chief Legal Officer. “The people were really extraordinary, some of the very best,” stated Ari Redbord, who was the Senior Adviser to the Treasury Deputy Secretary and the Under-Secretary for Terrorism and Financial Intelligence. “They basically put together the team that regulators would want to hear from when they are looking [at] how you’re going to build out a compliance programme.”

In an attempt to sway regulators, Libra also brought on former HSBC executive James Emmet as a managing director; Sterling Daines as Libra’s Chief Compliance Officer who previously worked at Credit Suisse, Goldman Sachs, and Deloitte in addition to consulting for the DOJ and the Financial Crimes Enforcement Network (FinCEN); Saumya Bhavsar as General Counsel after experience at Credit Suisse, UBS, Euroclear, and the OCC, in addition to the European Commission and British Parliament; and former aide to the Chairman of the U.S. Senate Banking Committee Susan Zook from Mason Street Consulting to lobby on behalf of Libra.

In addition to Mason Street, Libra spent over $7.5 million in 2019 alone on third-party lobbying firms including Sternhell Group, the Cypress Group, and the law firm Davis Polk & Wardwell, the latter of which had previously employed Fed Chair Jerome Powell and NY Senator Kirsten Gillibrand – one of the authors of the Stablecoin bill. Davis Polk & Wardwell are perhaps best known for representing the Sackler family-owned Purdue Pharma, infamous for their role in the U.S. opioid crisis, and for representing major Wall Street banks and firms during the 2008 crisis while also advising the government on the design of the bail-outs, some of which were deemed quasi-illegal even by its own lawyers. Facebook also hired the lobbying firm FS Vector, which was led by partner John Collins, the former Head of Policy at Coinbase, who had previously served as senior staff for the U.S. Senate Committee on Homeland Security and Governmental Affairs which in 2013 held “the first congressional inquiry and hearing into crypto and blockchain.”

By September 2020, Brock Pierce’s Blockchain Capital, featured in The Chain of Issuance, officially joined the Libra Association, leading Libra’s Head of Policy Dante Disparte to comment that the firm “would advise on the creation of its global payment system” and “make its network of experts and industry figures available for the Association’s use.” Bradford Stephens, a co-founder of Blockchain Capital, also joined the Diem Association board. By December 2020, Facebook had announced the rebranding of Libra to Diem, in no small part due to attempts to distance the project from the social network. “The original name is tied to an earlier iteration of the project that received a difficult reception, shall we say, from regulators and other stakeholders,” CEO Stuart Levey noted at the time.

The initial white paper and project outline for Libra described a synthetic stablecoin that would be pegged to a basket of fiat currencies and government bonds or Treasuries, referred to as the Libra Reserve. According to reporting from CoinDesk in October 2019, Marcus described some alterations to these intentions, claiming that “the new path isn’t necessarily Libra’s desired option.” However, the project must remain “agile.” Marcus further stated that Libra “could definitely approach this with having a multitude of stablecoins that represent national currencies in a tokenized digital form,” and that this is “one of the options that should be considered.” The pivot from a basket to a directly tokenized fiat currency was perhaps influenced by remarks from future SEC Chair and former CFTC Chair Gary Gensler, who argued in July 2019 that “as currently proposed, the Libra Reserve, in essence, is a pooled investment vehicle that should at a minimum, be regulated by the [SEC], with the Libra Association registering as an investment advisor.” Marcus reportedly told Reuters that Facebook still intended to launch Libra in June 2020 despite the regulatory pushback: “We’ll see. That’s still the goal.. We’ve always said that we wouldn’t go forward unless we have addressed all legitimate concerns and get proper regulatory approval. So it’s not entirely up to us.”

In April 2020, Libra announced the “offering [of] single-currency stablecoins in addition to the multi-currency coin,” in its mission to become “a complement” as opposed to “a replacement for domestic currencies” while expressing a “hope to work with regulators, central banks, and financial institutions” to “expand the number of single-currency stablecoins available on the Libra network over time.” The cover letter further explained the change from solely a Libra Reserve model:

“While our vision has always been for the Libra network to complement fiat currencies, not compete with them, a key concern that was shared was the potential for the multi-currency Libra Coin (≋LBR) to interfere with monetary sovereignty and monetary policy if the network reaches significant scale and a large volume of domestic payments are made in ≋LBR. We are therefore augmenting the Libra network by including single-currency stablecoins in addition to ≋LBR.”

In addition to the stablecoin modulation, the updated white paper removed “any mention of ever introducing permissionless participation in the Libra network” with “all counterparties operating nodes in the Libra network” remaining “known to all others.” “Regulators raised thoughtful questions about the perimeter of control for the Libra network – in particular, the need to guard against unknown participants taking control of the system and removing key compliance provisions,” the cover letter states in direct opposition to the original intentions for Libra “to become permissionless.”

By November 2020, just a month before the Diem rebrand, Libra again adjusted their plans to launch a “single dollar-pegged stablecoin next year” according to reporting from the Financial Times. Libra will “simply launch as a single coin” that is “backed 1:1 by the U.S. dollar,” assuming it receives “approval from the Swiss financial regulator FINMA.” The social network still claims that “the other currencies within the basket and the composite may still be rolled out at a later time,” whereas “the dollar-pegged coin could launch as soon as January [2021].” In February 2021, Diem announced a partnership with custodian Fireblocks and First Digital Assets Group to provide “the digital plumbing to allow financial service providers such as banks, exchanges, payment service providers (PSPs) and eWallets to plug into Diem on day one.”

According to previous reporting from Unlimited Hangout, Fireblocks has significant ties to the Israeli military and intelligence state, in addition to the U.S. regulatory regime via its advisory appointments of former SEC Chair Jay Clayton and Coinbase co-founder Fred Ehrsam:

“In 2022, Israel’s Ministry of Finance and the Tel Aviv Stock Exchange established the first digital government bond with Fireblocks (a digital assets security platform). The initiative was called Project Eden and it focused on three features: “the tokenization of fiat, the tokenization of government bonds, and instructions to prompt the exchange of assets.” Fireblock’s CEO and co-founder, Michael Shaulov, was a team leader in an elite military outfit, Unit 8200 (participating in the most demanding and mission-critical IDF projects).

In 2022, Fireblocks was the highest valued digital (tokenized) asset infrastructure provider, supporting over 800 major institutions. That same year, BNY Mellon, the world’s largest custodian bank, tapped Fireblocks to develop a financial infrastructure for managing their digital assets and, since then, Fireblocks has secured the transfer of $2 trillion in digital assets.”

Fireblocks has been funded by BNY Mellon, Silicon Valley Bank, Malka’s Ribbit Capital, Mike Novogratz’s Galaxy Digital, and DRW Venture Capital, among others. Fireblock’s employees include many former Unit 8200 and IDF members, not to mention CLO Jason Allegrante who worked at the Federal Reserve Bank of New York, Davis Polk & Wardwell and the San Juan Mercantile Bank & Trust, which was founded by Nick Varelakis, a former executive of the Tether-affiliated Noble Bank founded by Brock Pierce. In October 2024, Fireblocks announced a $1 million grant program to “boost PYUSD [PayPal’s stablecoin] developer adoption.”

This partnership ultimately yielded little benefit for Facebook, however. In May 2021, the social network again pivoted to partner with Silvergate Bank to issue their U.S. dollar-pegged stablecoin and manage its reserves. “We are committed to a payment system that is safe for consumers and businesses, makes payments faster and cheaper, and takes advantage of blockchain technology to bring the benefits of the financial system to more people around the world,” stated Diem CEO’s Levey. “We look forward to working with Silvergate to realize this shared vision.” Silvergate CEO Alan Lane added his own commentary, stating “we believe in the future of U.S. dollar backed stablecoins and their potential to transform existing payment systems. We’re inspired by Diem’s technology and commitment to building a regulatory compliant payment system.” The press release accompanying the announcement would also note that Diem would be moving its operations out of Switzerland and back to the United States.

Diem’s Levey and his executive team informed the Fed and the Treasury that they were planning on launching their stablecoin with Silvergate at the end of June 2021. In a heated phone conversation, the Fed’s general counsel Mark Van Der Weide told Levey that “the government was uncomfortable condoning any project until it had put a ‘comprehensive regulatory framework’ for stablecoins in place,” while expressing “nervousness about a coin with the potential to ‘massively scale’ as Diem might.” Levey would respond publicly, while demanding “fair and equal treatment.” “Stopping a limited, legally permissible pilot while other stablecoins grow unchecked is neither fair nor equitable.” In response to the “No” from the U.S. regulatory regime, Dante Disparte, then-Executive Vice President at Diem Association, quit in frustration only to join Circle, the issuer of USDC, in April 2021.

In August 2021, Marcus appeared on Bloomberg Technology to discuss the recent developments of Diem:

“In the early days, the idea the big idea of Libra was really one that had a stablecoin that included a number of existing currencies instead of just being aligned with a dollar, which is what is being prepared now. Also it was to be regulated in Switzerland, and since then the team at Diem brought this back to the U.S. to be regulated in the U.S. given it was a dollar stablecoin that was worked on. And so now it’s basically in the process of getting approvals to move forward, and getting the proper licensing structure to actually move forward.”

Diem co-founder Catalini subsequently made comments to CoinDesk to further articulate their plans for the Silvergate collaboration, including a commitment to phase their token out once a CBDC was issued:

“What we’re really suggesting is more of a public-private partnership. We see this almost like a temporary exercise, where issuers like Silvergate in collaboration with Diem will be issuing a diem dollar, but the moment there is a CBDC … We are the only issuer of a stablecoin, to my knowledge, that committed publicly to phasing out our own token and replacing it with a CBDC token.”

Before Diem could launch their stablecoin with Silvergate, in October 2021, Facebook announced yet another partnership with Paxos, a trust company and stablecoin issuer with numerous connections to PayPal, as profiled in The Chain of Issuance. The pilot program was set to “go live in the U.S. and Guatemala” which would allow “users to start trading the Paxos Dollar (USDP)” while “crypto exchange Coinbase will provide custody services for the program.” According to a Coinbase blog post at the time of announcement, Novi users who participated in the pilot could “acquire Pax Dollar (USDP) through their Novi account,” allowing Novi users to “be able to transfer USDP between each other instantaneously,” which “Novi will hold on deposit with Coinbase Custody.” As Paxos’ Head of Strategy Walter Hessert stated in Paxos’ blog post, “This news represents a tide shift in digital assets, as it’s the first time that stablecoins are readily available in a consumer wallet outside of the crypto ecosystem.”

The very same day, October 19, 2021, a group of U.S. Senators – Brian Schatz (D-HI), Sherrod Brown (D-OH), Richard Blumenthal (D-CT), Elizabeth Warren (D-MA) and Tina Smith (D-MI) – penned an open-letter to Facebook demanding the immediate discontinuation of the Novi pilot. According to reporting from CoinDesk, the lawmakers felt that “Facebook cannot be trusted to protect user data or manage a payments network,” in the letter published “just hours after Facebook announced it was launching a pilot program for its Novi wallet subsidiary.” Excerpts from the timely letter include the following:

“On multiple occasions, Facebook has committed not to launch a digital currency absent federal financial regulators’ approval. In prepared remarks before the House Financial Services Committee in October 2019, you said that Facebook would ‘not be a part of launching the Libra payments system anywhere in the world unless all U.S. regulators approve it.’ More recently, David Marcus, the executive overseeing Facebook’s digital currency efforts, said, ‘[w]e are definitely not going to launch without the proper regulatory framework.’

Despite these assurances, Facebook is once again pursuing digital currency plans on an aggressive timeline and has already launched a pilot for a payments infrastructure network, even though these plans are incompatible with the actual financial regulatory landscape – not only for Diem specifically, but also for stablecoins in general. The agencies that oversee the U.S. financial system are studying the risks that stablecoins pose to financial stability. Accordingly, they are considering how to address these inherent risks and clarify regulation and supervision of these products. As Federal Reserve Chair Powell said of stablecoins at a July 2021 Senate Banking and Housing Committee hearing, ‘They’re like money funds, they’re like bank deposits and they’re growing incredibly fast but without appropriate regulation.’ Acting Comptroller of the Currency Hsu recently likened stablecoins to the wholesale funding markets whose collapse precipitated the 2008 financial crisis: ‘In terms of ‘known knowns,’ a run on a large stablecoin could be highly destabilizing.’ Mr. Marcus has cited Facebook’s success in securing ‘licenses or approvals for Novi in nearly every state,’ and concluded that ‘Novi is ready to come to market.’ To be clear, your ability to secure state-issued money transmitter licenses is not equivalent to obtaining the blessing of ‘all U.S. regulators,’ as you said in your testimony two years ago.

In addition to the risks products like Diem pose to financial stability, you have not offered a satisfactory explanation for how Diem will prevent illicit financial flows and other criminal activity. The intergovernmental Financial Action Task Force warned in a report to the G-20 finance ministers that stablecoins’ ‘propensity for mass-adoption makes them more vulnerable to be used by criminals and terrorists to launder their proceeds of crime and finance their terrorist activities.’ The President’s Working Group on Financial Markets said in December 2020 that stablecoins ‘are likely to attract illicit actors and, without appropriate mitigation measures, allow evasion of key public policy objectives.’

Unfortunately, Facebook’s decision to pursue a digital currency and payments network is just one more example of the company ‘moving fast and breaking things’ (and in too many cases, misleading Congress in order to do so). Time and again, Facebook has made conscious business decisions to continue with actions that have harmed its users and the broader society. Facebook cannot be trusted to manage a payment system or digital currency when its existing ability to manage risks and keep consumers safe has proven wholly insufficient.”

The letter concluded, “We urge you to immediately discontinue your Novi pilot and to commit that you will not bring Diem to market.”

The Dismantling of Libra

Despite the pivots, despite the new partners, and despite pandering to regulators across the globe, Diem never actually made it to market. Surprisingly, Facebook and its Libra/Diem agents were quite open in their acknowledgments that this was a likely final outcome, one foreseen by some even from the start of the project. In a conversation with CNBC in November 2019, Marcus was asked by Andrew Ross Sorkin, “What did you think was gonna happen then in terms of the expectation for how [Libra] would roll out and play out in the public?” Marcus’ answer was brief and to the point: “Well, almost as it actually happened.” In line with this sentiment, Facebook itself acknowledged that regulatory issues may be an insurmountable barrier to its Libra project in their quarterly report to the SEC in June 2019:

“Libra is based on relatively new and unproven technology, and the laws and regulations surrounding digital currency are uncertain and evolving. Libra has drawn significant scrutiny from governments and regulators in multiple jurisdictions and we expect that scrutiny to continue. As a primary sponsor of the initiative, we are participating in responses to inquiries from governments and regulators, and adverse government or regulatory actions or negative publicity resulting from such participation may adversely affect our reputation and harm our business.

As this initiative evolves, we may be subject to a variety of laws and regulations in the United States and international jurisdictions, including those governing payments, financial services, and anti-money laundering. In many jurisdictions, the application or interpretation of these laws and regulations is not clear, particularly with respect to evolving laws and regulations that are applied to blockchain and digital currency. These laws and regulations, as well as any associated inquiries or investigations, may delay or impede the launch of the Libra currency as well as the development of our products and services, increase our operating costs, require significant management time and attention, or otherwise harm our business.

In addition, market acceptance of such currency is subject to significant uncertainty. As such, there can be no assurance that Libra or our associated products and services will be made available in a timely manner, or at all.”

In a conversation with Harry Stebbings of 20VC, Marcus explained how the failure to convince regulators on the merits of Diem led him to call it quits:

Marcus: “When I think about the Facebook adventure with Libra – I still call it Libra because it’s a better name than Diem – when I basically decided it it was not worth fighting for it anymore, I felt really good, like really, really good, that we had tried everything in our power and then some to convince regulators and world powers, basically, that this was something of merit and that the world needed, but it just wasn’t going to happen.”

Stebbings: “What was the core reason it wasn’t going to happen?”

Marcus: “I think it was just really hard for regulators and others to accept that Facebook would be at the center of a protocol for money for the internet. And actually that any private company would be at the center of that and that’s why we devolved so much power into this consortium that we didn’t control, that we’re just a member of, but that wasn’t enough. And I think that the political – it was very political to be clear – and I think the political pressure on regulators to not enable a company with the reach of Facebook to actually be at the helm of such a project was just insurmountable.”

In an August 2023 conversation with Bankless, Marcus furthered these sentiments while articulating that “Unfortunately, no one actually believed the power dynamics behind it,” and that the “brand association with Facebook at the time was just not palatable from a political standpoint.” Marcus even went so far as to confirm that “the project was killed or shut down by the government.”

The fact that the government would be so hostile to Facebook’s digital currency efforts is interesting in light of the fact that Facebook was one of the vehicles used to privatize controversial U.S. military surveillance projects after 9/11. Shortly after Peter Thiel and associates created Palantir with CIA funding to privatize, and thus rescue, DARPA’s then-embattled Total Information Awareness program, Thiel became Facebook’s first significant investor at the behest of Sean Parker, whose first contact with the CIA took place at age 16. What Facebook became after the involvement of Thiel and Parker bore such an uncanny resemblance to another shuttered DARPA project of the same era, known as LifeLog, that LifeLog’s architect has even noted the direct parallels. One of these parallels, though left unmentioned by former DARPA project managers, is the fact that Facebook launched the very same day that LifeLog was shut down. Facebook’s long-standing ties to the military/intelligence communities, which go far beyond its origins to revelations about its collaboration with spy agencies as part of the Snowden leaks and its role in influence operations – some of which have involved the Thiel-founded Palantir – makes one wonder if the animosity of the government toward Facebook’s digital currency ambitions was merely a smokescreen and that the real intent was in perfecting the public-private partnership of capital creation for the digital age, specifically its surveillance potential.

Despite the predicted failure to launch, Marcus recognized that Libra “served as a blueprint for a lot of projects that came after.” As Lisa Ellis of Moffet Nathanson explained to FT, Diem “forced regulators and governments to start to educate themselves on the technology and stimulated venture capital investment in other initiatives because there was such a frenzy of focus.”

These sentiments were seemingly confirmed in both the projects later headed by former Libra staff, not to mention the venture capital invested in said businesses. While Marcus’ LightSpark will be discussed later, Sui and Aptos, two “descendants” of Libra raised $300 million and $350 million respectively, both leveraging Libra’s Move programming language. Aptos was funded by Andreessen Horowitz, Multicoin Capital, 3 Arrows Capital, Tiger Global, FTX Ventures and Coinbase Ventures. Sui, the blockchain built by Mysten Labs which added native USDC availability in October 2024, was founded in September 2021 by four former members of Libra. Mysten Labs, which co-authored a troubling paper with O.N.E. Amazon’s co-founders – including the architect of BlackRock’s ETFs, Peter Knez, as described in previous reporting from Unlimited Hangout – is deeply tied to Facebook and its Libra/Diem project. Evan Cheng, Mysten’s co-founder and CEO, was previously the head of Research and Development at Novi Financial, while Sam Blackshear, another co-founder and the CTO of Mysten Labs, was previously the Chief Engineer at Novi, having contributed significantly to the creation of the Move programming language used by Libra/Diem while at Meta. The founding team at Mysten also includes Adeniyi Abiodun and George Danezis, key contributors to Diem’s stablecoin and the aforementioned Move programming language.

In January 2022, the Diem Association formally folded by announcing the sale of its intellectual property related to the Diem Payment Network to their former partner, Silvergate Capital Corporation for $182 million. In the press release, Diem’s CEO Levey eulogized Facebook’s effort, claiming that despite “a senior regulator inform[ing] us that Diem was the best-designed stablecoin project the US Government had seen,” and “despite giving us positive substantive feedback on the design of the network,” it “nevertheless became clear from our dialogue with federal regulators that the project could not move ahead.” Levey commented on the continuing intentions of Libra even after the sale, stating that “we remain confident in the potential for a stablecoin operating on a blockchain designed like Diem’s to deliver the benefits that motivated the Diem Association from the beginning.”

Unfortunately for Levey, and those behind the efforts of the social network’s crypto project, Silvergate itself would be shutdown in March 2023, by the very same regulators that had first shuttered Libra.

The Regional Banking Crisis

Silvergate Bank was founded as a savings and loan association in 1988 by Dennis Frank and Derek Eisele. In 1996, Frank, an ex-Goldman Sachs banker, reorganized the S&L into a regional bank servicing the Southern California area after recruiting investors he had met from his stint at Goldman. Frank convinced the board of Silvergate to cease its mortage operations in 2005, a few years before the subprime debacle. Thus, when the Great Financial Crisis struck in 2008, Silvergate remained solvent and ready to lend. At the onset of the crisis, Frank asked Alan Lane to join the bank as CEO, having spent time at Independence One Bank, Business Bank of California, and Southwest Community Bancorp. According to reporting from CNBC, Lane shared that Frank told him “I’m a Wall Street guy and I need a banker as a partner, would you join me?”

While the bank’s books were balanced, the standard issue of banking remained: how to garner customer deposits in order to fund loans. At the start of the 2010s, Silvergate would turn towards the oft-unbanked cryptocurrency industry to fill their coffers. In 2013, Lane purchased his first Bitcoin, partially out of interest in a new industry, and partially out of fear of how this upstart currency could disrupt the banking sector at large. “I thought ‘uh oh, what am I gonna do?’” Lane expressed upon discovering the blockchain. “I put two and two together and I thought, well it might disrupt banking long-term but in the short-term these companies need banks. They’re not doing anything wrong. They’re not doing anything illegal or immoral. If they were we wouldn’t be banking them.”

In 2013, Lane brought in the executives from a handful of “young crypto exchanges” in order to assess their areas of friction, and how Silvergate could help the blossoming blockchain industry. A year prior, Silvergate had received Federal Reserve status, and in the Summer of 2014, Lane had invited the California State Banking Department board and the Federal Reserve Bank of San Francisco to share what he had learned from the exchanges, and more specifically present the merits of Bitcoin. “That open communication with the regulators early on has proven to be really foundational,” Lane would share. “We’re very collaborative with the regulators, we ask them if they have suggestions, and what we can do better.”

Silvergate quickly added the Winklevoss twin’s Gemini exchange, Paxos, Kraken, and others to their list of crypto-clients, helping the bank source much needed deposits, while also providing an olive branch to a smattering of mostly unbanked blockchain stalwarts. As FTX’s Sam Bankman-Fried put it himself in a now-deleted testimonial on Silvergate’s website, “Life as a crypto firm can be divided up into before Silvergate and after Silvergate. It’s hard to overstate how much it revolutionized banking for blockchain companies.” In January 2014, Silvergate brought on on their first crypto customer, SecondMarket, a firm started by Barry Silbert of the not-yet-founded Digital Currency Group.

SecondMarket was built to facilitate the sale of private securities, such as shares of companies not yet publicly listed. Its investors included FirstMark, Chamath Palihapitiya’s Social Capital, Temasek Holdings, Silicon Valley Bank, and Li Ka-shing among others, the latter being the controversial father of Block.one investor, Richard Li, as noted in The Chain of Consensus. SecondMarket was also advised by Steven Bochner – a former Chairman of the board of directors at Nasdaq, a former member of the board at the SEC, and a member of the board at the Federal Reserve Bank of San Francisco – in addition to being advised by Alan Denenberg, a partner at Davis Polk & Wardwell.

SecondMarket later rebranded as Genesis Trading in April 2015 with Genesis Trading naming their new CEO, Brendan O’Connor, after Silbert resigned in July 2014 in order to form the Digital Currency Group. O’Connor told CoinDesk that Genesis Trading was “the largest over-the-counter market maker” in cryptocurrency, as well as being the “first broker-dealer in the U.S. regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) to actively trade bitcoin.”

Nearly a decade later, both Genesis Trading and Silvergate would find themselves caught in the middle of the Terra-LUNA and FTX controlled demolitions. Terra’s Do Kwon accused Genesis Trading, via their subsidiary Genesis Asia Pacific, of collaborating with Sam Bankman-Fried’s FTX and Alameda Research in order to attack the peg of the algorithmic stablecoin TerraUSD, known as UST. Kwon, in a series of tweets dated December 7, 2022, suggested that “the time has come for Genesis Trading to reveal if they provided the $1B USD shortly before the crash to SBF or Alameda.” The $1 billion dollar purchase was indeed brokered by Genesis Trading’s Asia Pacific, in addition to another $500 million sourced from Three Arrows Capital, with the deal being officially announced as closed on May 5, 2022. Genesis Trading’s own Twitter account explained that “the Genesis aspect of the deal represents the first of its magnitude, with Genesis Asia Pacific Pte. Ltd. taking on 1 billion UST in exchange for $1 billion worth of BTC.” By May 12, Terra’s LUNA had lost 99.7% of its value, and the $1 billion of UST stable now held by Genesis was effectively worthless.

Kwon also questioned SBF himself, specifically looking for answers as to why his trading desk Alameda had borrowed over $1 billion worth of Bitcoin from Voyager during the de-pegging, alluding to possibility that the borrowing was related to a large short position on the Terra ecosystem. Kwon would also “reveal” that Alameda was responsible for the “large currency contraction that UST went through in Feb 2021” due to Alameda selling 500 million in UST “in minutes” to “drain the Curve liquidity pools during the Magic Internet Money (MIM) crisis.” FTX would officially lose around $100 million on the failure of LUNA. However, reporting from the New York Times would back Kwon’s assertion that SBF’s firms were behind the massive sell orders of TerraUSD. As covered inThe Chain of Consensus, the fallouts of Terra-LUNA’s collapse were crucial in creating the context that later led to FTX’s insolvency. It is of note that the Bitcoin that had once backed Terra-LUNA’s stablecoin was algorithmically liquidated via Binance, which was a long time banking client of Silvergate, having reportedly moved some $50 billion for the exchange through Silvergate accounts since 2019. The CEO of FTX’s Digital Markets, Ryan Salame, asserted via a Tweet that “Silvergate advised all our banking activity.” In the aftermath of their bankruptcy filing, FTX revealed that Genesis Global Capital “turned out to be the largest unsecured creditor of FTX” to the tune of $226.3 million owed.

The SEC went on to sue Silvergate for their participation in the FTX scandal, with the July 2024 suit claiming “SCC, Lane, and [former Chief Risk Officer Kathleen] Fraher misrepresented the operational and legal risks facing the Bank by falsely stating in SEC filings and other public statements that the Bank had an effective BSA/AML compliance program tailored to the heightened risks posed by its crypto asset customers.” According to reporting from Blockworks, the Silvergate staff “were able to trace $9 billion worth of transfers from FTX-related entities,” yet the lawyers at the SEC wrote: “Most troubling to the BSA staff was the trend of funds that flowed from FTX’s custodial accounts — which held FTX customer funds — to a series of non-custodial FTX-related entities’ accounts, followed by transfers of these funds to other third parties — either through the SEN or to accounts external to the Bank.” According to reporting from NYMag, SEC filings showed that “funds intended for FTX were deposited into the Silvergate account of an Alameda subsidiary” in order to “hide the fact that they were going to Alameda.” This subsidiary, North Dimension, claimed to be “an online electronics retailer” according to “a now-defunct website that appears to have been fake since nothing could be purchased on it.”

SEN, or the Silvergate Exchange Network, had become a critical piece of infrastructure for inter-exchange settlement in addition to providing much needed settlement services for stablecoin providers. As Alan Lane explained on Bloomberg’s OddLots podcast in 2022:

“We are the regulated on-ramp from the U.S. dollar and other fiat currencies into the bitcoin and digital asset market. And then likewise, we are the off-ramp from that the digital asset market back into fiat currencies… So let’s talk about the stablecoins. The stablecoin issuers who use our platform are all of the regulated, U.S. dollar-backed stablecoin issuers… We don’t bank the algorithmic stablecoin offerings, nor these other stablecoins that are maybe collateralized by other digital assets. Those don’t need a U.S. dollar bank because they’re not backed by USD. Importantly, we also don’t bank Tether and believe it or not, we had the opportunity to work with Tether very early on but because they weren’t inside the United States. And, you know, again we are very serious about regulation, and so we looked at it and we thought you know this is an interesting idea… But they’re offshore. We can’t really get our hands around their regulatory status in the United States and so we were not able to bank them back then. This was back in 2017, nor do we bank them today. So that’s what we don’t do.

What we do is for USDC, for the Pax Dollar which is issued by Paxos, for the Gemini Dollar issued by Gemini and for TrueUSD. They use the SEN and our API for the minting and burning of their tokens. Those tokens are issued when a dollar hits their Silvergate bank account and it’s all programmatic. So if somebody wants to purchase USDC from Circle, what they would do is they would send dollars into Circle’s bank account at Silvergate. And when those dollars hit the bank account then, at that moment, there is an API call from Silvergate to Circle that says ‘we just received x amount of dollars from this customer.’ And at that point, Circle knows we have the dollars in our possession. So they turn around and they mint the USDC token and send it to the wallet address of that institution that is looking to purchase the USDC. And then the same thing happens in reverse. If someone wants to redeem their USDC and go back to U.S. dollars, they send the USDC to the wallet at Circle. Circle, at that point, once they have possession of the USDC, they then send an instruction to us via API and we then, in turn, will send the dollars back to that prior USDC token holder.”

According to a SEC filing with data as recent as October 2018, Silvergate serviced 35 digital currency exchanges, including “the 5 largest U.S. domiciled digital currency exchanges,” holding just over $792 million of deposits. The filing stressed the importance of SEN, while also highlighting the substantial growth of Silvergate’s “digital currency initiative.” In 2014, with only 8 customers, the bank held $6 million in crypto-related deposits, whereas by 2018, the bank had 483 crypto clients, with $1.6 billion in deposits on the bank’s books.